Weekly Market Commentary: Pushing new highs

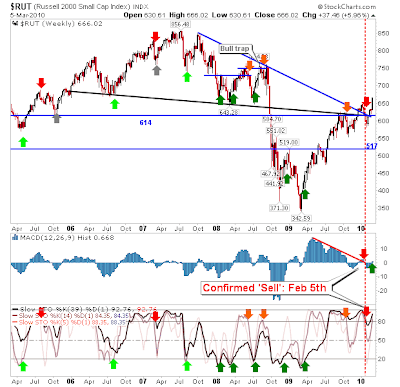

It was left to small caps to lead and lead they did. The week closed with an almost 6% gain for the Russell 2000 which was enough to return a MACD trigger 'buy' and negate 2008 reaction lows as resistance. Is next resistance up around 750? The positive move from small caps filtered down to Tech But large caps still lagged Market Internals were left either overbought (although there was a Confirmed 'Buy' signal) or close to resistance with significant bearish divergences at play But momentum is with the bulls for now. Follow Me on Twitter Build a Trading Strategy in Zignals; Read how and earn real money (once out of Beta) in this PDF. Dr. Declan Fallon, Senior Market Technician for Zignals.com , offers a range of stock trading strategies for global markets under the user id: ‘Fallond’, ‘ETFTrader’ and ‘Z_Strategy’ available through the latest rich internet application for finance, the Zignals Dashboard or the Zignals Trading Strategy MarketPlace . Zignals offers a ful