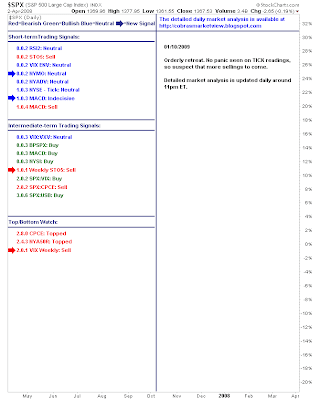

Stock Market Commentary

The Nasdaq, Nasdaq 100 and Russell 2000 all gave up their 20-day and 50-day MAs, handing large caps the leadership role following their moving average breaks on Friday. Tech averages also lost rising support from November lows. Large caps saw increased weakness with technical 'sells' in MACD, On-Balance-Volume and the ADX. The building weakness has turned into something more than just a pullback of an advance, but instead looks like a developing retest of November lows. Short term technicals are oversold, so if the next bounce stalls out at the 20-day/50-day MAs then the retest is confirmed. Dr. Declan Fallon, Senior Market Technician, Zignals.com the free stock alerts, market alerts and stock charts website