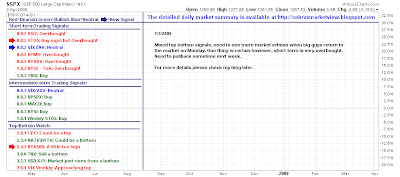

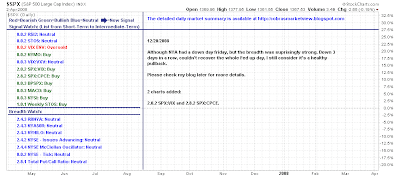

Nasdaq wedge breakout

On a closing basis the Nasdaq has managed to crack through resistance, but has done so on a background of falling money flow and overbought momentum. The developing bearish divergence in money flow isn't helping The good news is the freed room to 2,100 and/or 200-day MA, assuming it can hold above former resistance (now support) as marked by the broadening wedge. I haven't seen the TICK this consistently bullish in a while; no real overbought condition either which is unusual considering other breadth indicators A downward move looks likely today based on futures, so it will be matter of where support will kick in, and from that, what we are lookng at from the broader picture Dr. Declan Fallon, Senior Market Technician, Zignals.com the free stock alerts, market alerts and stock charts website