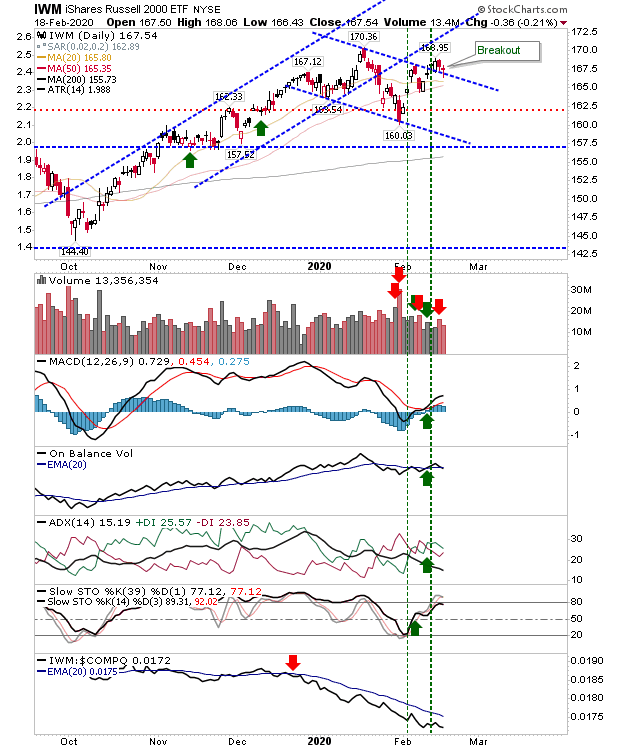

Holding Last Week's Upside Gaps; Russell 2000 Poised

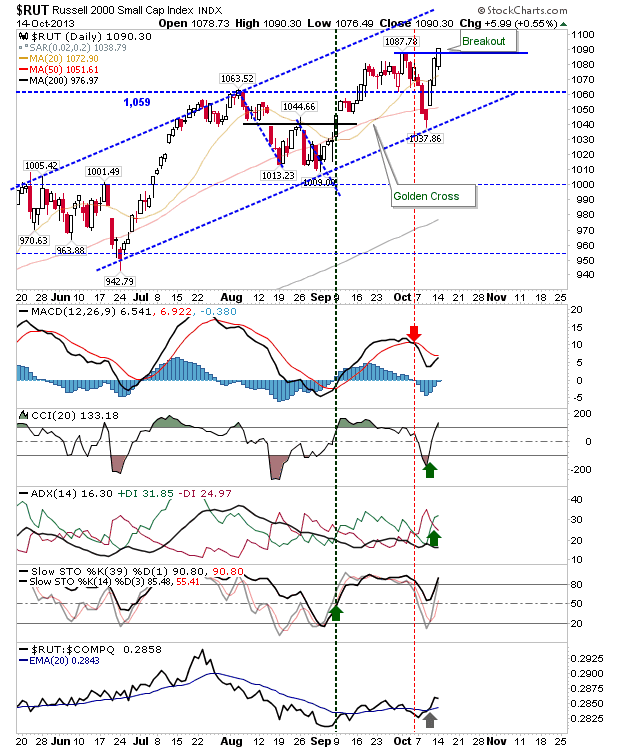

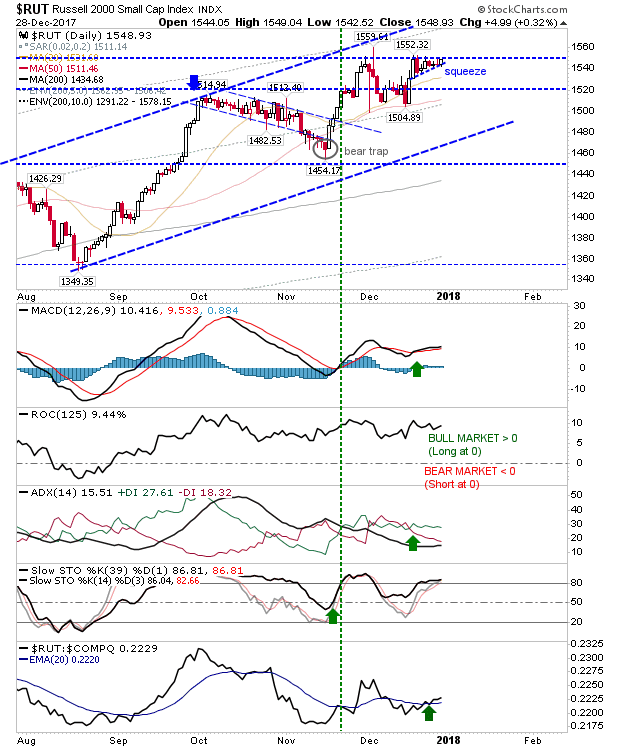

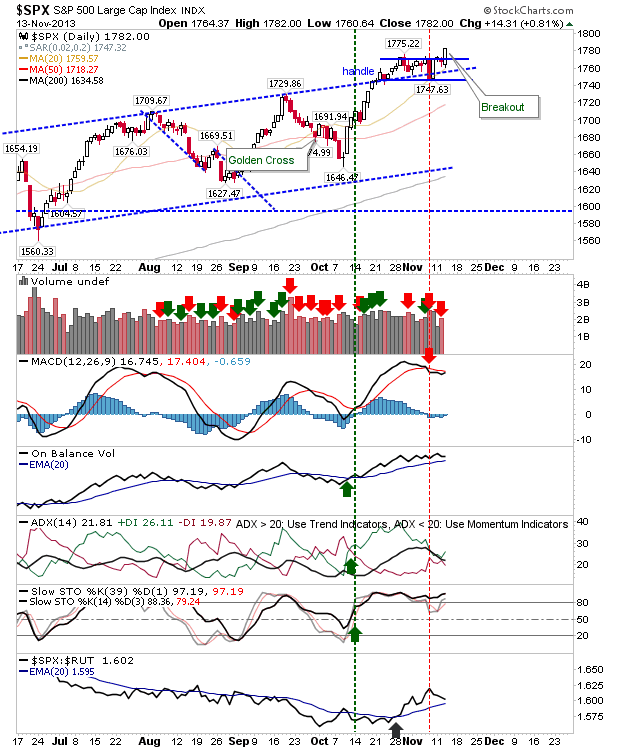

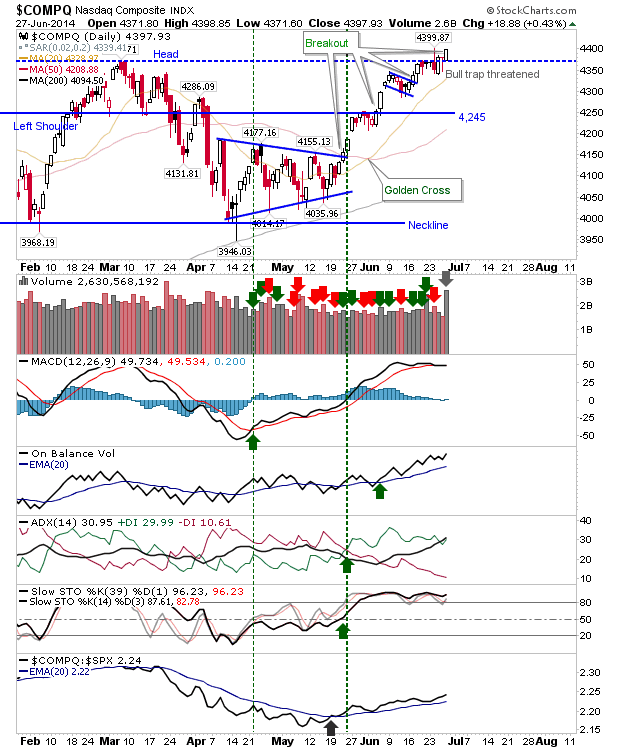

A shaky start to the week has so far managed to hold on to Friday's gains. The small gaps haven't filled although they are not true breakout gaps as we are still waiting for the actual breakouts. But, it's healthy action and the possible short opportunities mentioned from the drop outside of the channel don't look likely to succeed. The S&P is no longer in its rising channel but a slower advance may be emerging. The MACD is still on a 'sell' signal and relative performance remains on the bearish side.