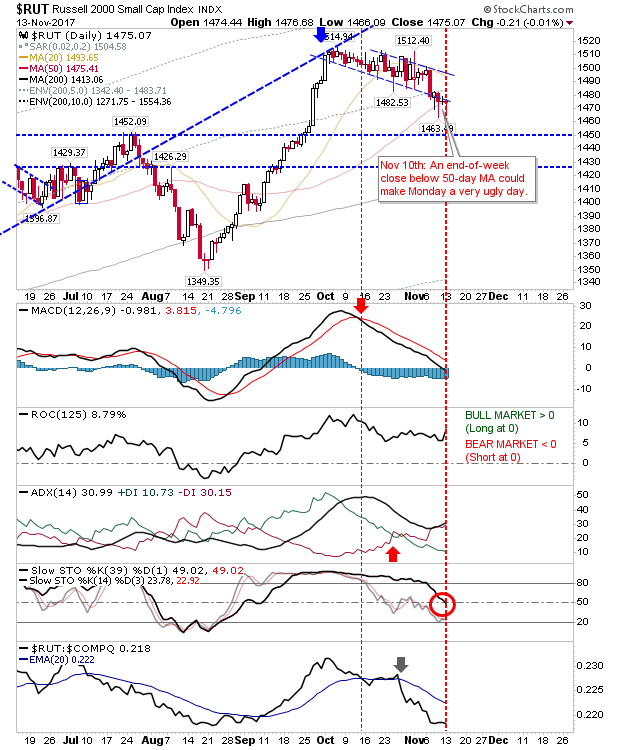

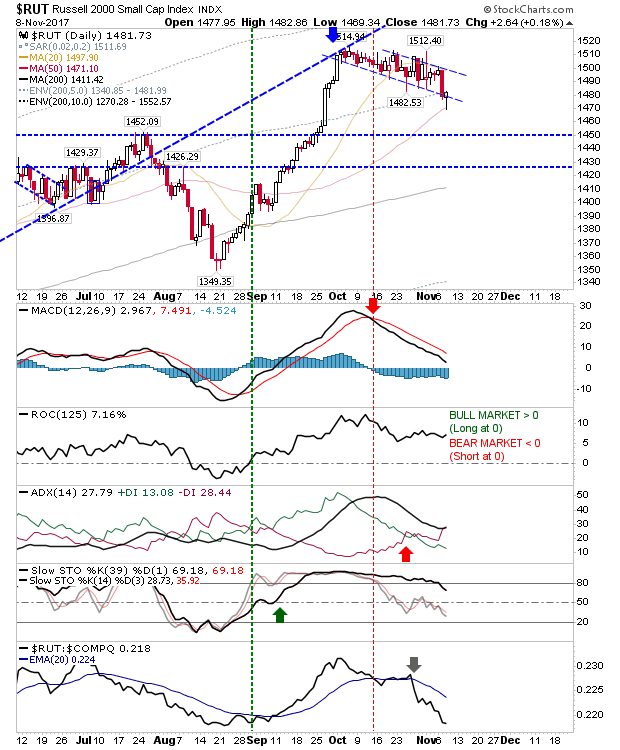

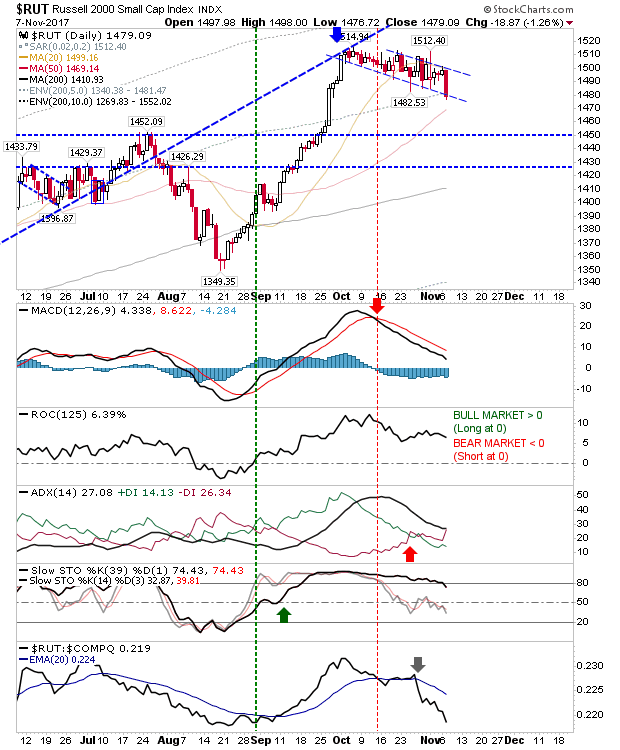

It wasn't a particularly exciting Friday but there were some points-of-action of interest. I had tweeted about the weakness in the Russell 2000 but there wasn't much satisfaction for either side. The Russell 2000 finished with a narrow doji at the 50-day MA. As it failed to close below the 50-day MA bulls will be satisfied with a successful defense of the 50-day MA but the narrow intraday range offers a bigger swing trade off a break of the high/lows from Friday. There is still a chance a break below the 50-day MA will kickstart an acceleration towards the 200-day MA and this still looks like the preferred outcome. Any move back inside the 'bull flag' will open up for a 'bear trap' and a likely break of 1,500 - a move above 1,480 will open up a long trade opportunity.