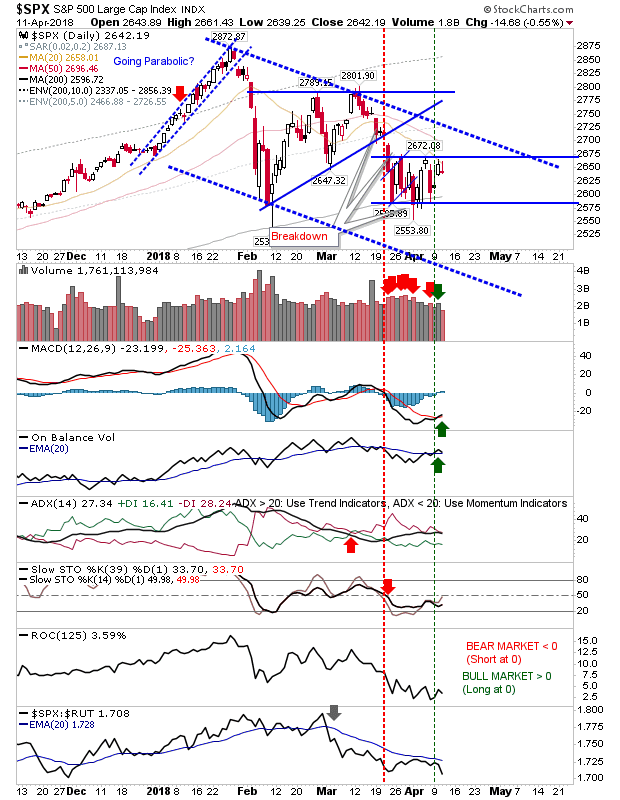

Tentative Breakouts Fail To Hang On

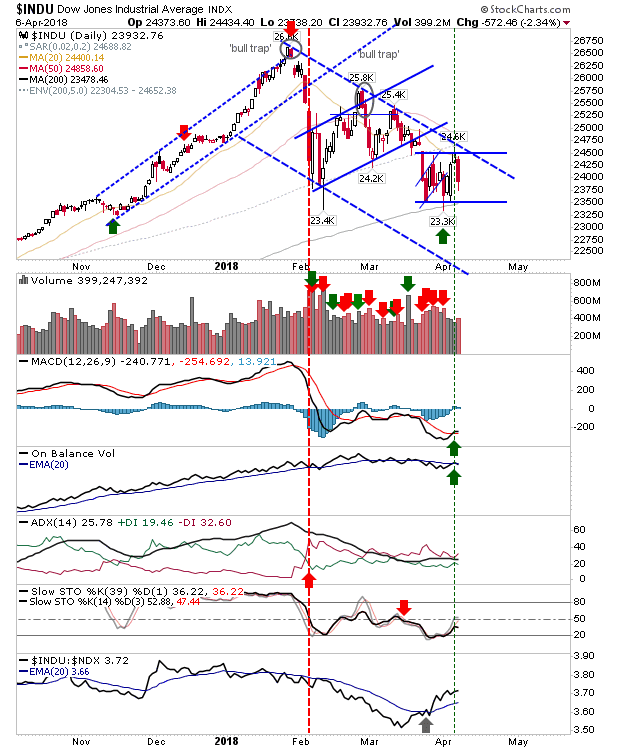

Markets had started Friday above the marked consolidations I had drawn on the charts but subsequently ended the week still inside these trading ranges. As a two-day pattern, Friday's close finished as a bearish engulfing pattern across markets which means I'll be looking for a break of newly drawn ascending support (of the last 8 days) in these indices. The S&P still has a MACD and On-Balance-Volume trigger 'buy' signals but Friday's high (and the high of the bearish engulfing pattern) was the 50-day MA. Sidelined bulls will want to see a convincing break of the 50-day MA, and probably the downward channel before committing. Bears have the easier play - helped by the strong relative underperformance of the index against its peers. Short the loss of Friday's low with a stop above 2,680.