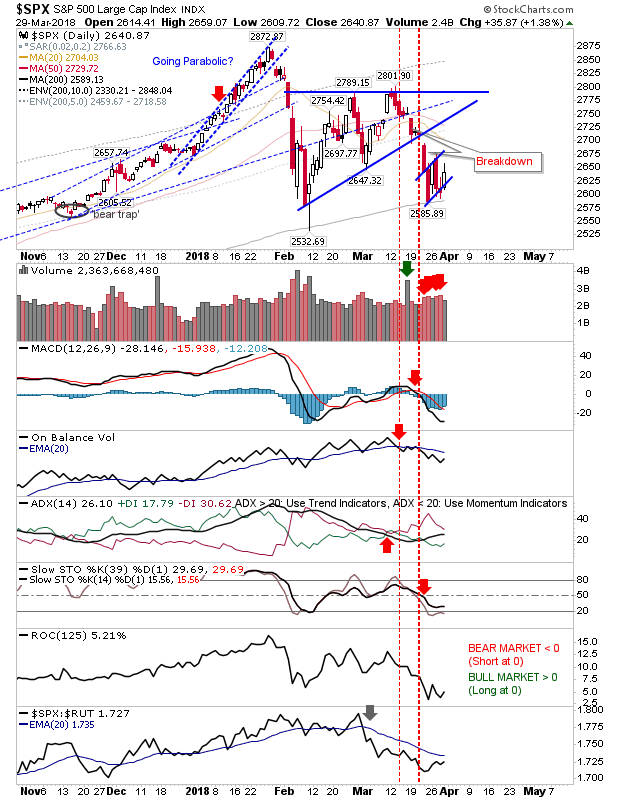

Dow Breakout

Markets look to have found a new routine with 200-day MAs acting as working support. The 'bear flags' I had marked for the S&P and Dow Jones Industrial average look toast given the latter index has broken resistance from what now looks to be a horizontal consolidation. However, the larger consolidation from all-time highs has yet to be challenged but could see a test Friday or Monday.