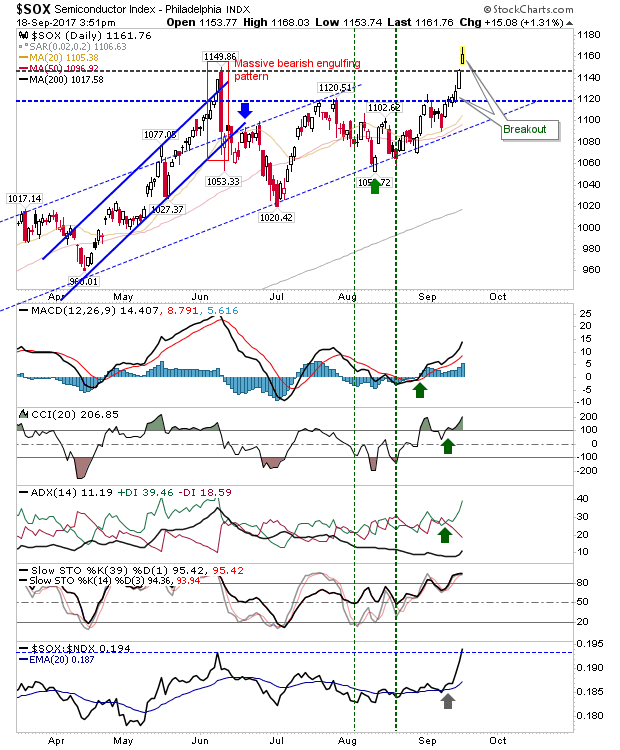

Semiconductors Breakout

It was somewhat disappointing not to see the Nasdaq and Nasdaq 100 make the break from resistance. However, the Semiconductor index did manage a breakout of 1,150. There was some weakness into the close but the fact the bearish engulfing pattern has been negated means the bearish overhang created by this pattern has been consumed.