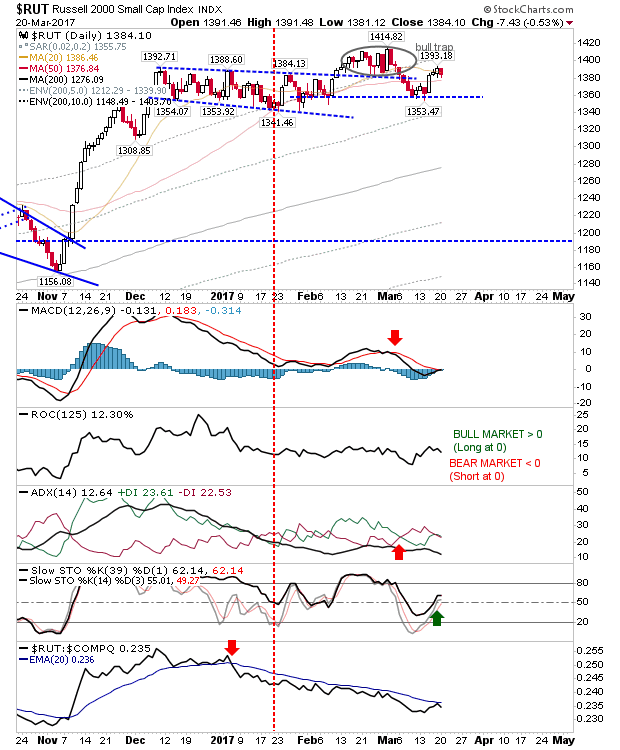

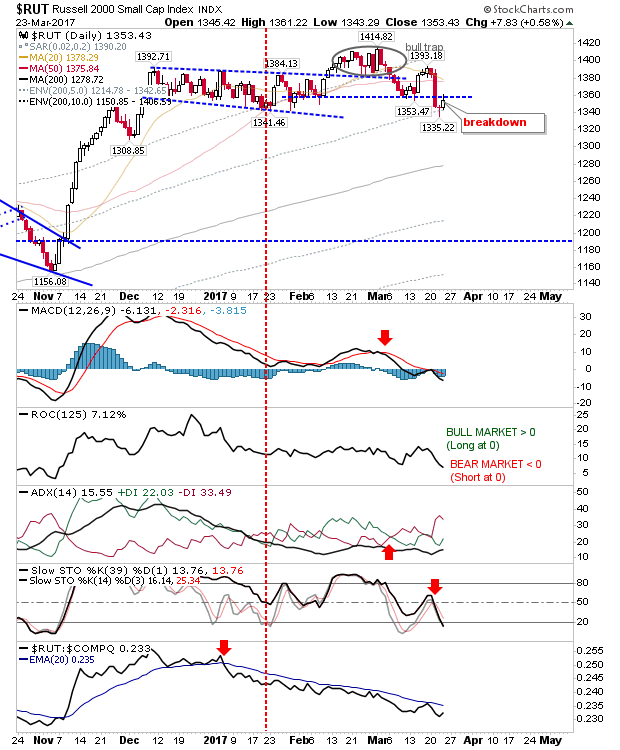

Indecision Strikes

It was no real surprise to see indices slow down in their recovery. Across the board doji mark a balance between buyers and sellers. The one index which bucked the trend a little was the Russell 2000. It staged a modest recovery which brought it back to former support turned resistance. However, technicals remain firmly bearish, and will stay this way even if there are additional gains.