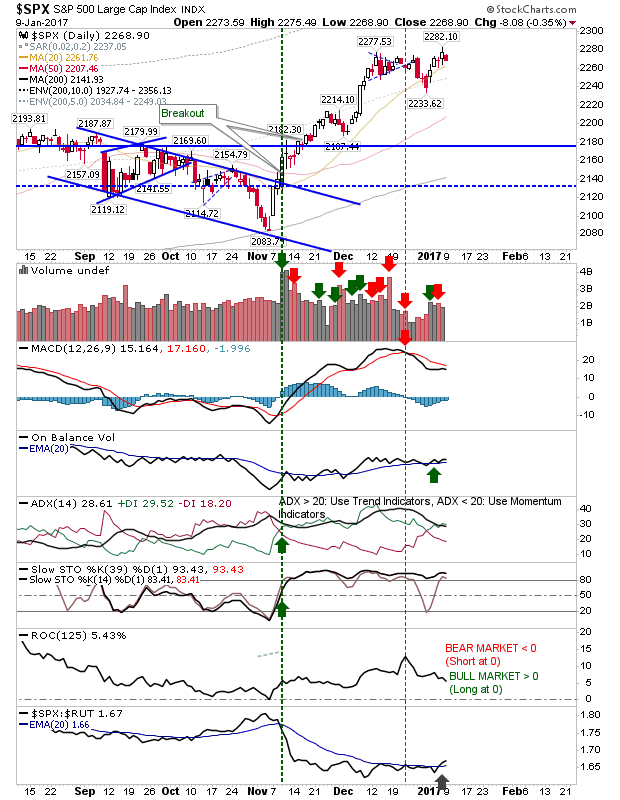

It was another good day for bulls, particularly for the S&P. An acceleration in weakness brought about in late morning action was reversed with steadying buying over the last two hours of trading. The S&P has been range bound since early December. Today's action didn't change that, but it suggests the breakout - when it comes - will be higher. The Nasdaq also felt pressure with it own sell off. Volume was down on recent weeks, but it was enough to keep bulls in control. The Russell 2000 had a quiet day, registering just a 0.05% gain. The best of the news was it not drifting back to support, where the risk of a major breakdown lurks. For tomorrow, look for bulls to continue their good work. The Russell 2000 looks least likely to do anything exciting, but the S&P (and Dow) is well positioned for a breakout. You've now read my opinion, next read Douglas' blog. I trade a small account on eToro, and invest using Ameritrade. If you would li