Broad Selling

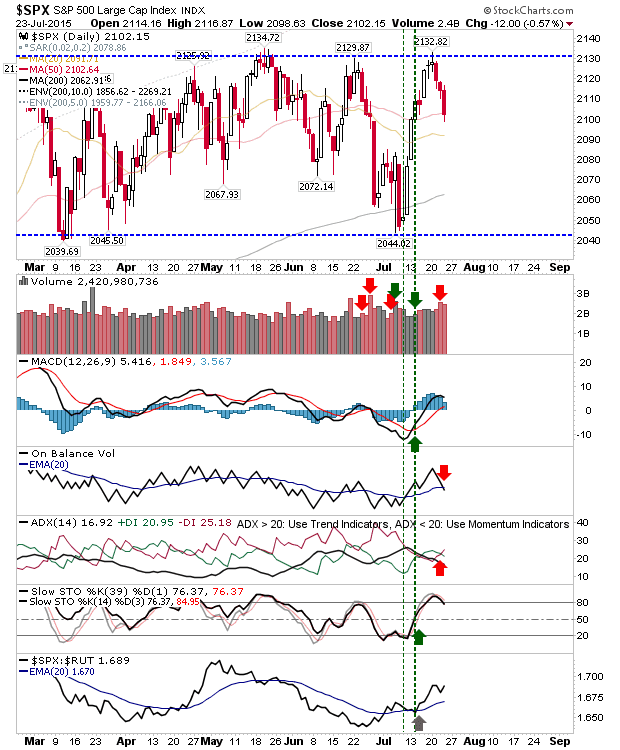

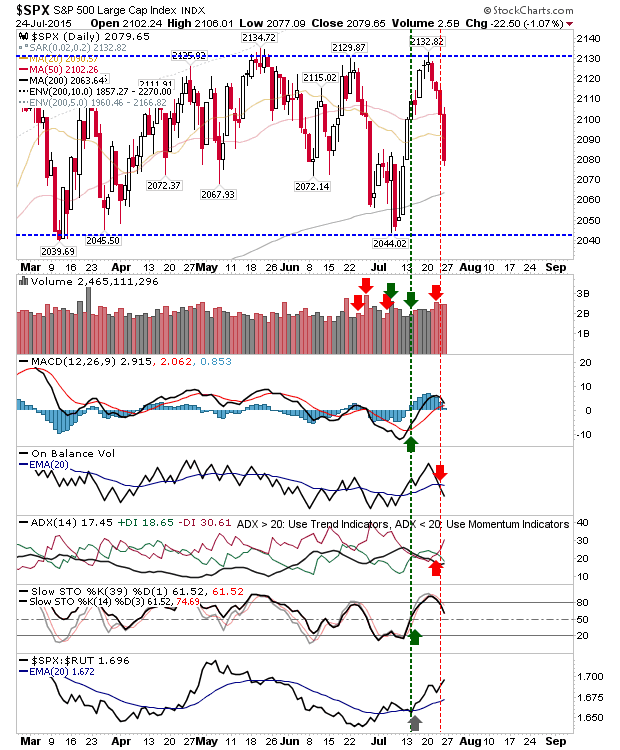

There was no doubt as to the nature of Friday's action. A weak, end-of-week close adds to the negative tone, suggesting the damage is more long term. However, not all indices are in true bearish mode. The S&P is stuck inside its range, and won't be challenging range lows until 2,045 comes into play. The 200-day MA at 2,063 is an area to look for buyers, although the last test of this key moving average was in early July, which is a little too soon for a new test to hold again. Technicals are mixed, which fits with what is trading range action. Bears may win in the long term, but bulls may get some joy at the 200-day MA for a short term bounce play.