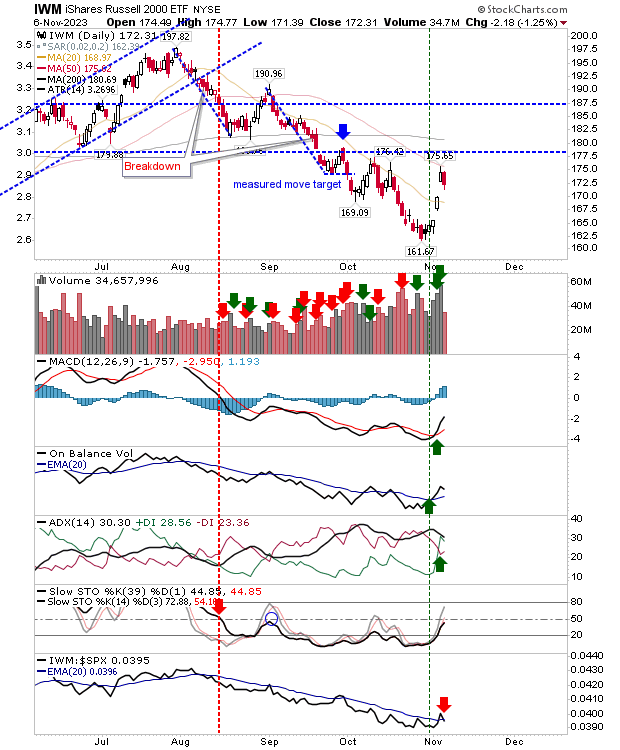

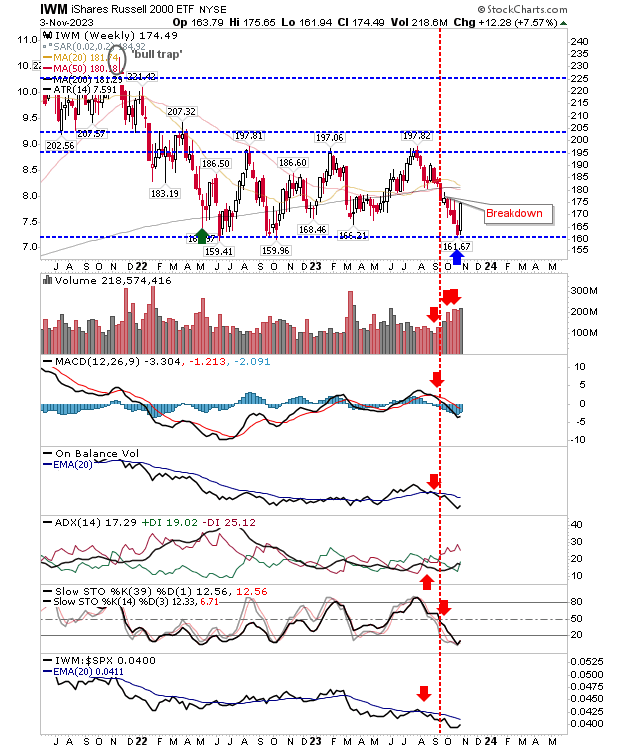

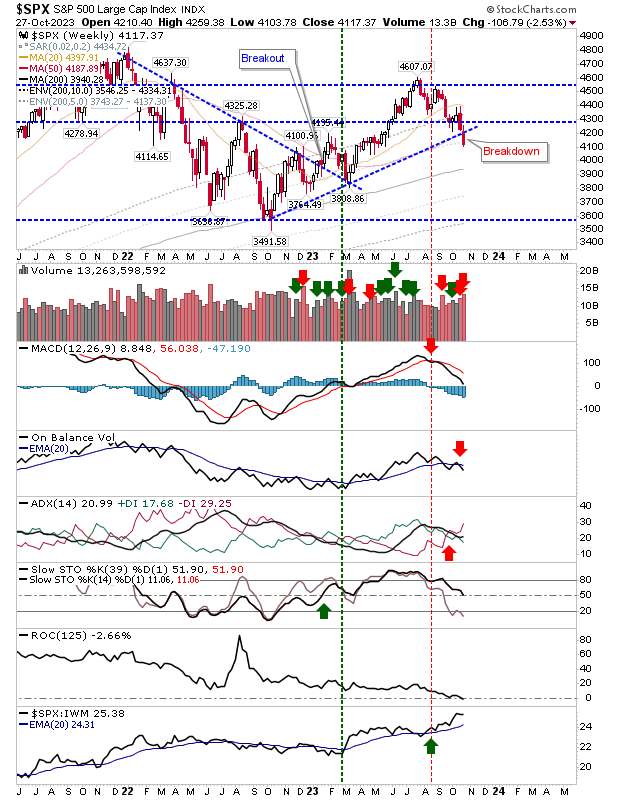

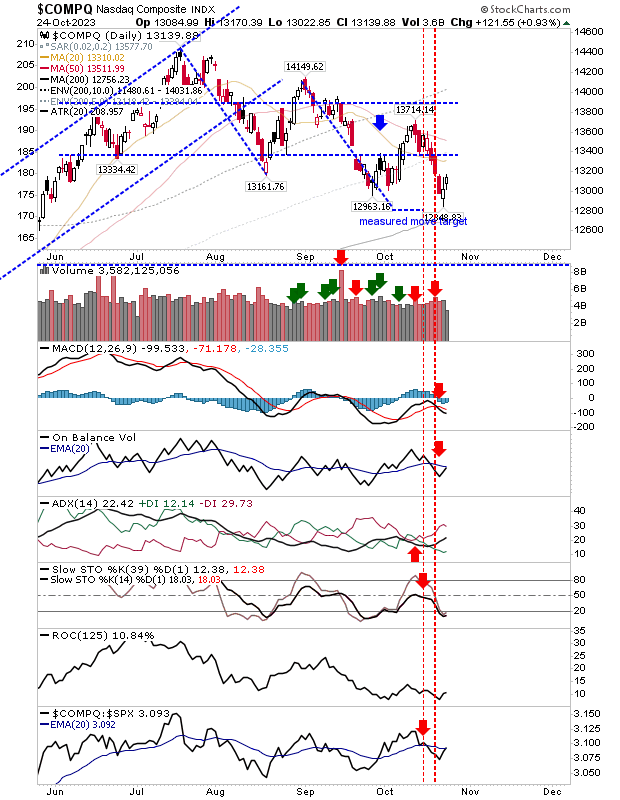

At this stage, only weekly time frames are important as we track "Crash Watch". It's a tricky situation as the S&P and Nasdaq don't look vulnerable, but the Russell 2000 ($IWM) is really struggling. Starting with the Nasdaq, we have a technical negative picture but it that remains above 200-day MA support. This looks like an index in the process of forming a (multi-year) trading range, but even if this is the case, it's still early days as no trading range boundaries have been set. The S&P tagged its 200-day MA, returning above this moving average after today's close. Buying volume was less than previous days selling distribution, but there are grounds for buyers to step in at a logical support level. The Russell 2000 ($IWM) did manage to post a gain today, but the candlestick was a neutral doji, not one to inspire confidence. Technicals are bearish and oversold and show little sign of a recovery. It's still early in the wee