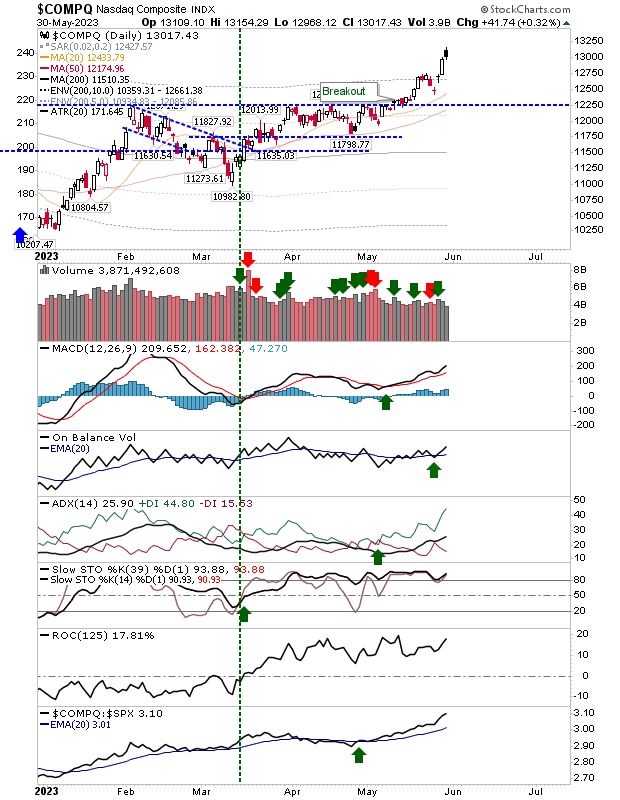

S&P and Nasdaq rally in their bases.

Currently on vacation, so posting intermittently until after July 4th. Suffice it to say, the S&P and Nasdaq are well on their way to shaping the right-hand side of bases coming off 2021 highs. There is still a chance these bases can fail, but until I next post, I expect these rallies to continue on weekly timeframes.