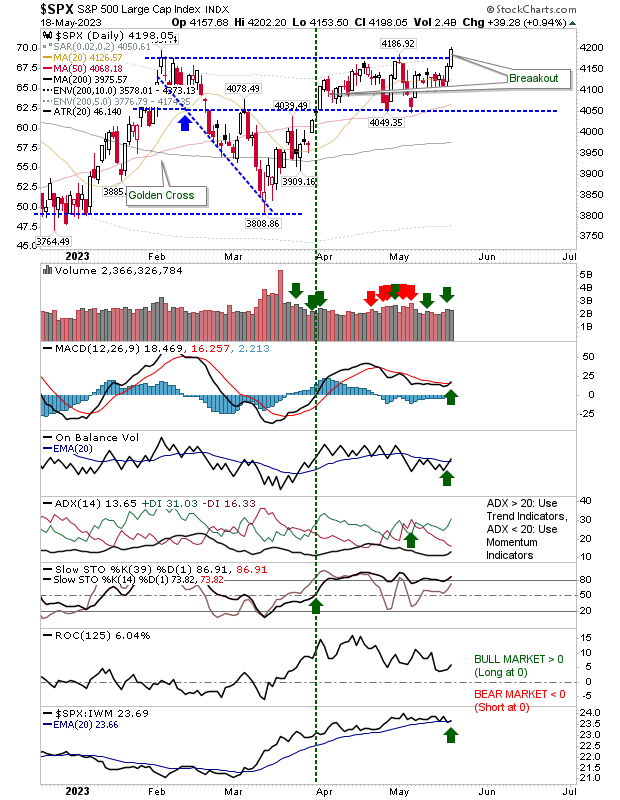

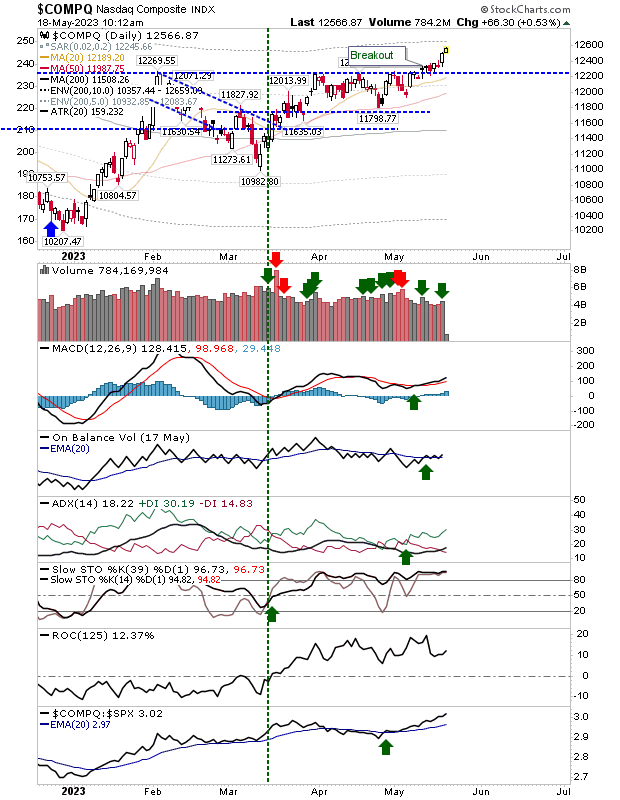

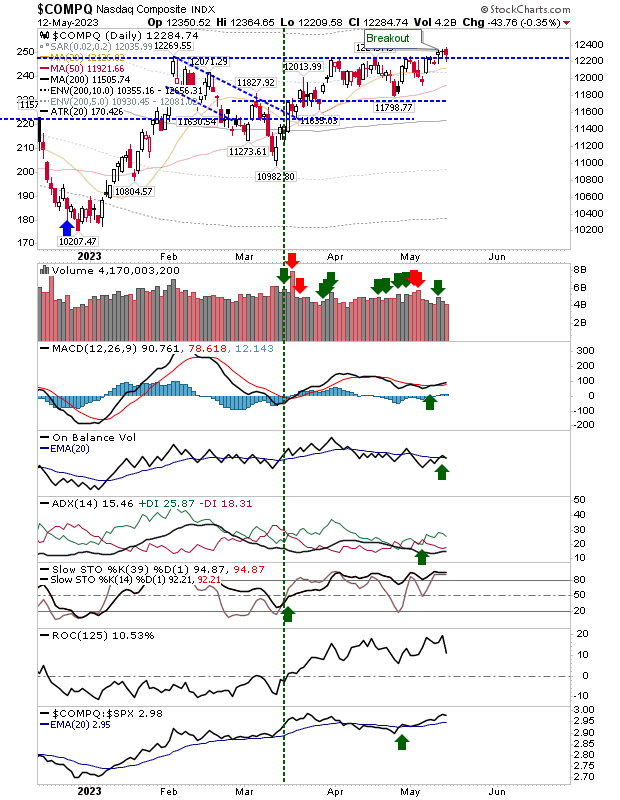

"Black Candlesticks" are a concern for the S&P and Nasdaq

A bright start for bulls on the back of positive $NVDA earnings wasn't enough to generate a day of meaningful gains. However, it did help stall the losses of the last couple of days. The Nasdaq was the biggest beneficiary of today's action, but not enough to see an end-of-day finish that cleared last week's swing high, nor delivery of a large white candlestick, despite the morning breakout gap. Technicals are net bullish and relative performance against the S&P has become consistently stronger since the start of May. While today's candlestick I would view as typically 'bearish', today's volume ranked as confirmed accumulation (bullish). Overall, I would be looking for higher prices from here.