Index bounces reach a pause point

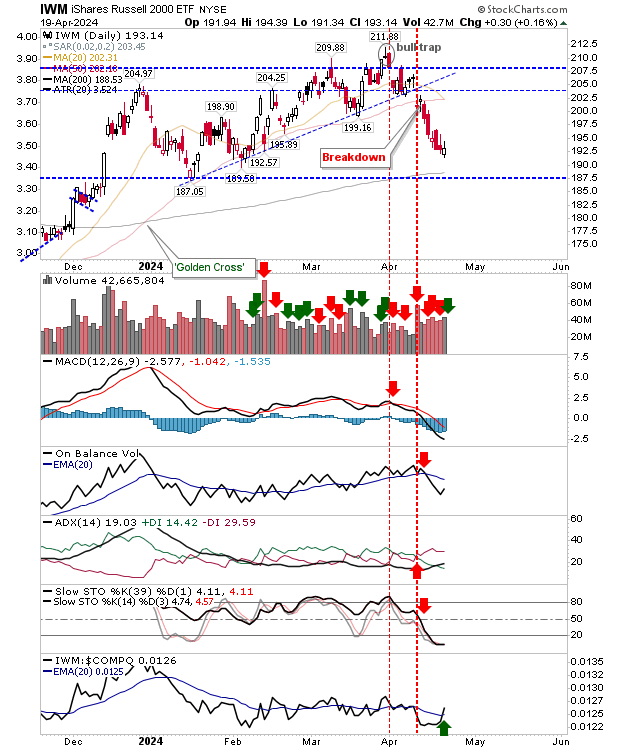

The relief bounce for indices finally hit the first potential reversal point with 'black' candlesticks in the S&P and Nasdaq, and a bearish harami cross for the Russell 2000 ($IWM). Trading volume in the Russell 2000 was lighter than previous days, a positive sign for those looking for more from this bounce. Momentum indicators have moved out of an oversold state, although I like to see a cross of the mid-line before I consider the situation to be under the control of bulls. The S&P closed the day with a more bearish 'black' candlestick, a common reversal candlestick on a bounce, but more so at a new high. Technicals are weak and net bearish that increases the chance for a bearish reversal. Watch for a gap down on the open. It was a similar story for the Nasdaq as for the S&P; a bearish 'black' candlestick on net bearish technicals. If indices do start heading lower, watch for the measured move targets which for the Nasdaq and