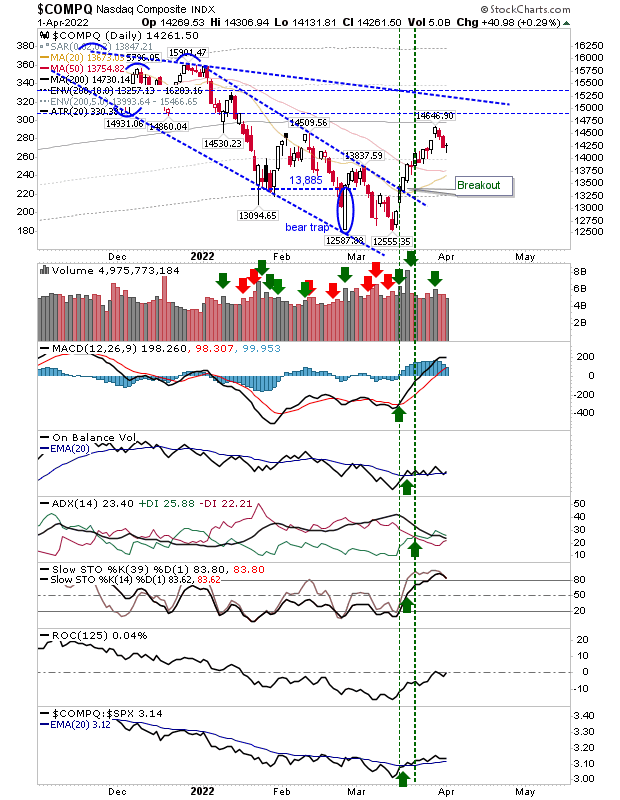

Mini-Correction in March Bounce

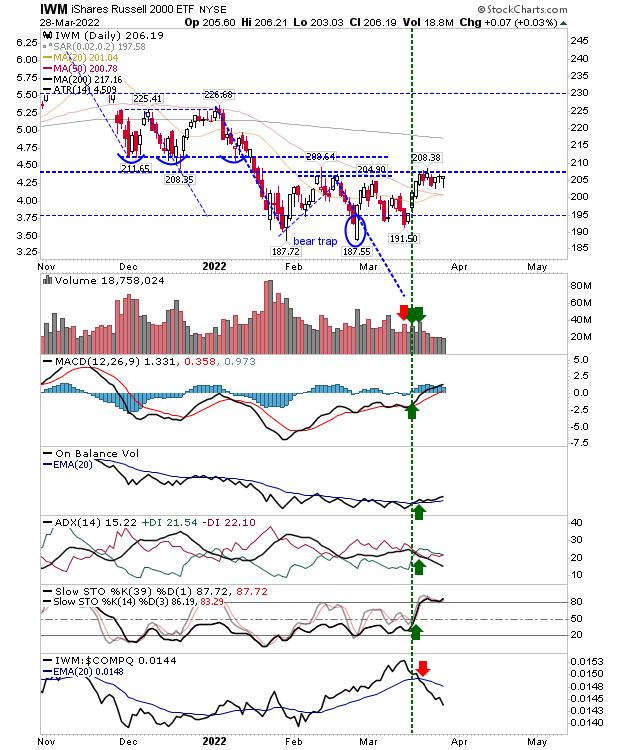

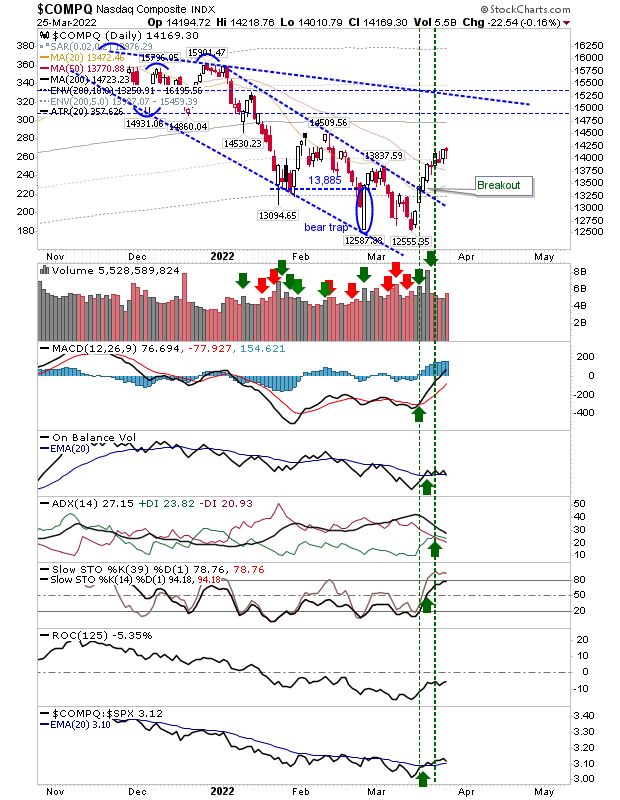

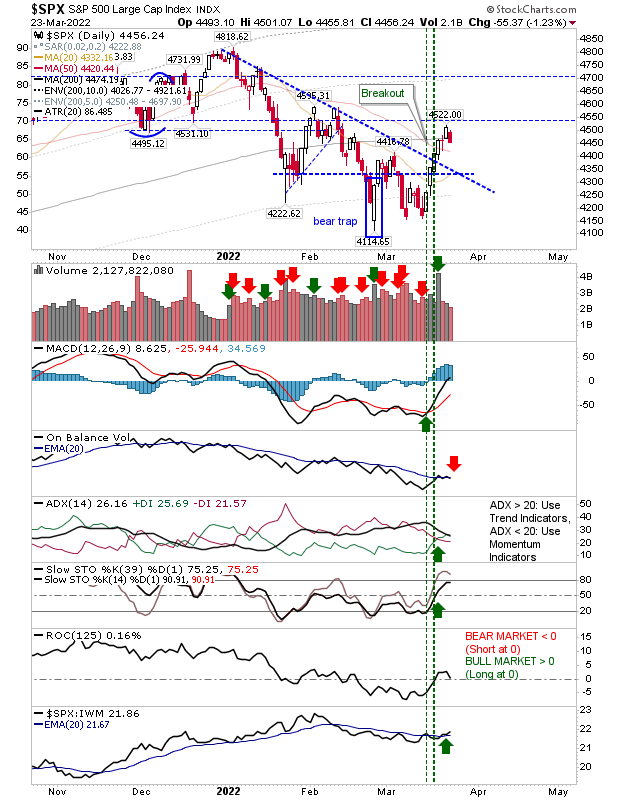

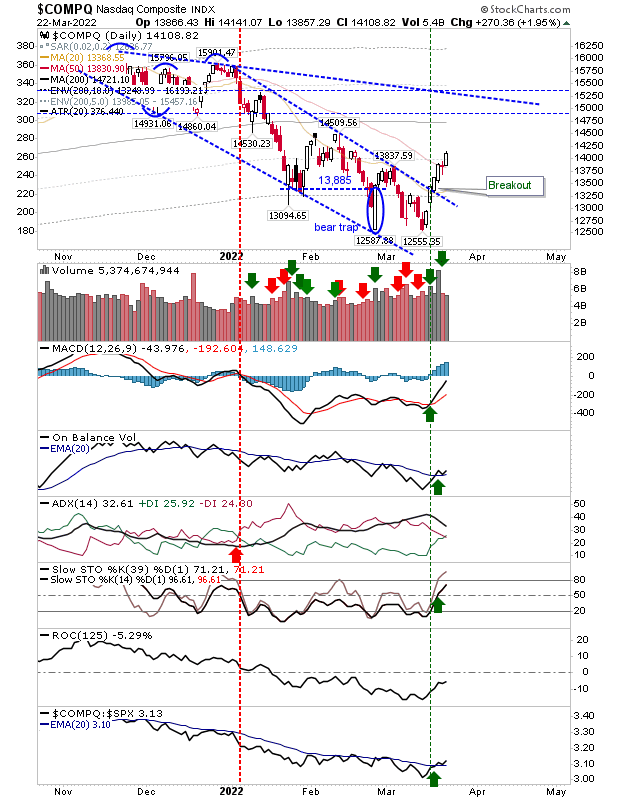

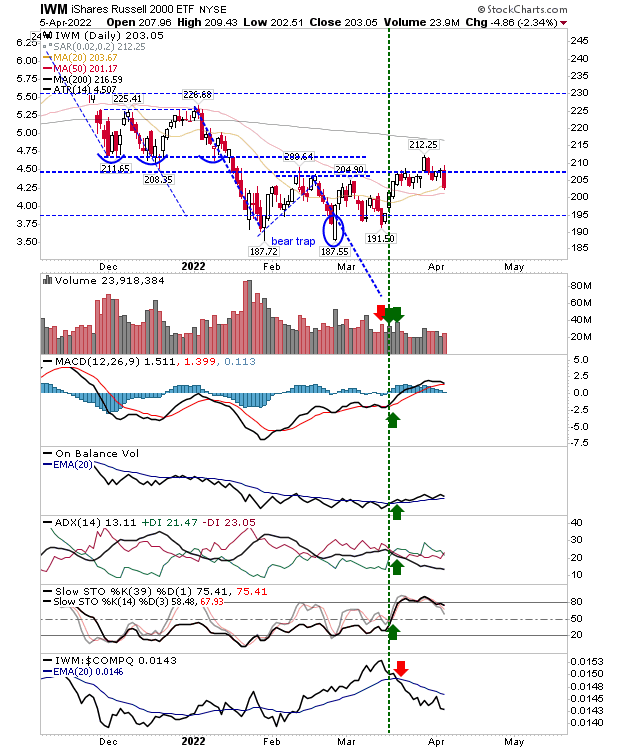

It has taken a while, but we are finally seeing the correction in the rally which was started by the (surprising) rally following the February low test. It looks like a buyers pullback, but there may yet be further losses before we see this move done. The index most impacted by today's selling was the Russell 2000 as it lost its base-building breakout, and prices were returned into its earlier base. Selling volume was relatively light (compared to January), but today's trading qualified as a distribution day. Technicals remain net positive and it will now have the 50-day MA to lean on as support.