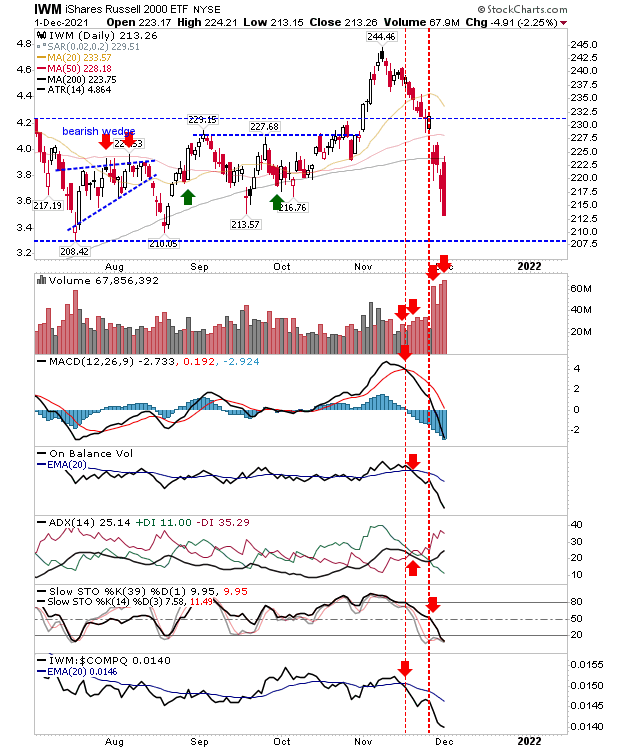

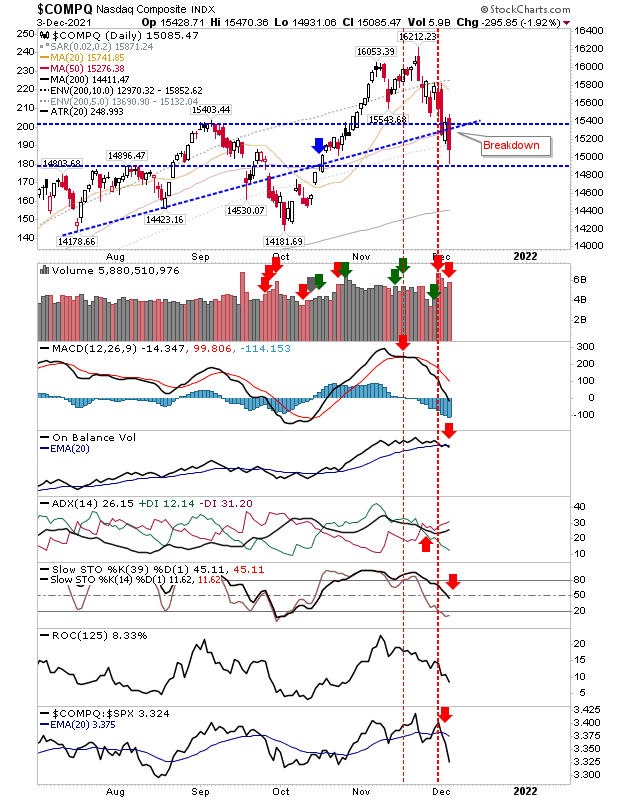

Nasdaq breaks support as the Russell 2000 continues to fall

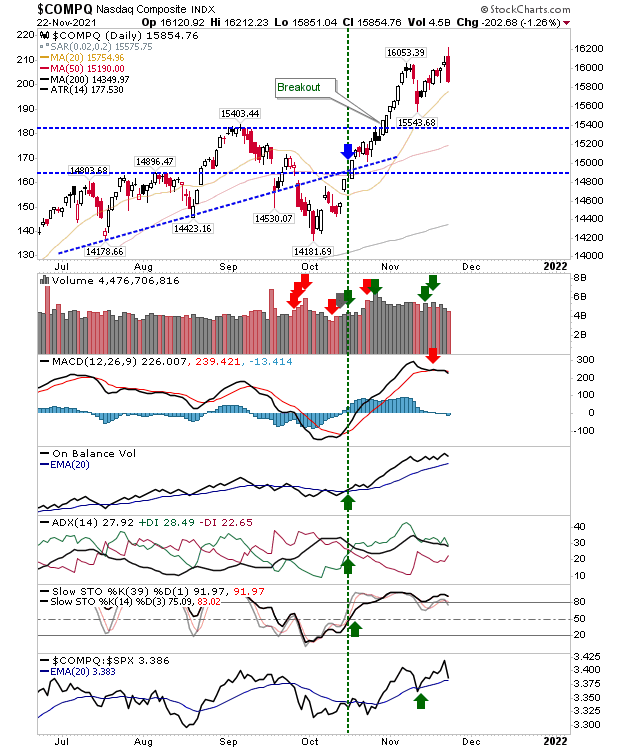

Indices continue to fall as traders grab profits before the holidays. While the Russell 2000 is the index feeling the most pain it handed the headlines over to the Nasdaq on Friday when it undercut its 50-day MA, on higher volume distribution. Technicals are net negative, but internediate term stochastics are not oversold. The index is underperforming relative to the S&P as it works its way towards its 200-day MA.