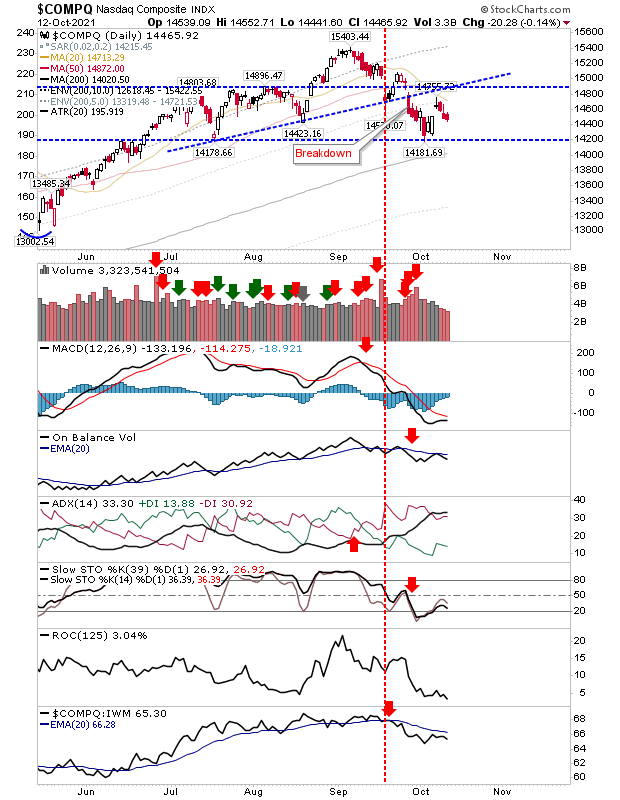

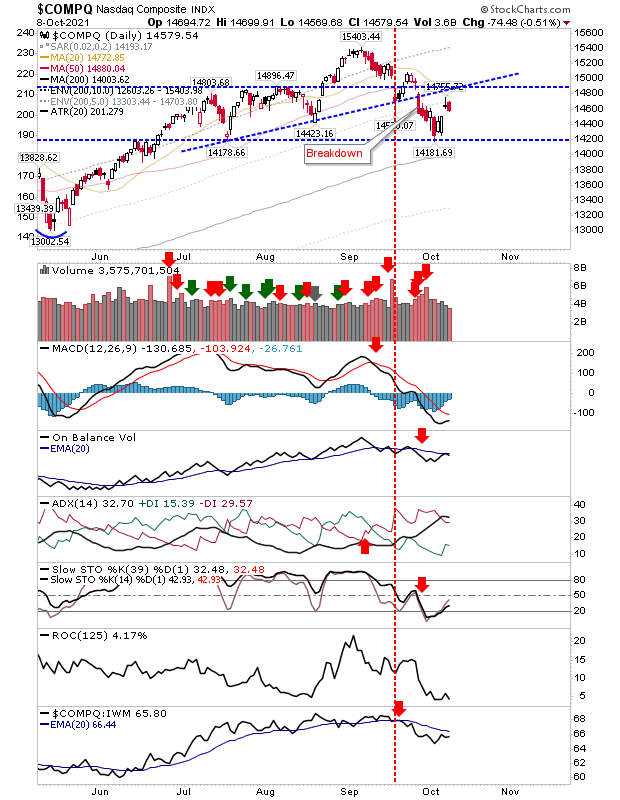

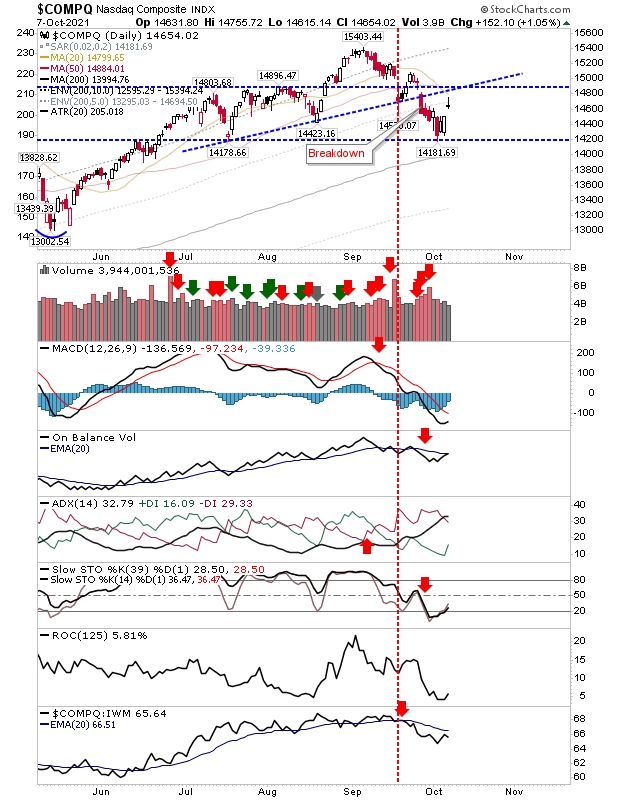

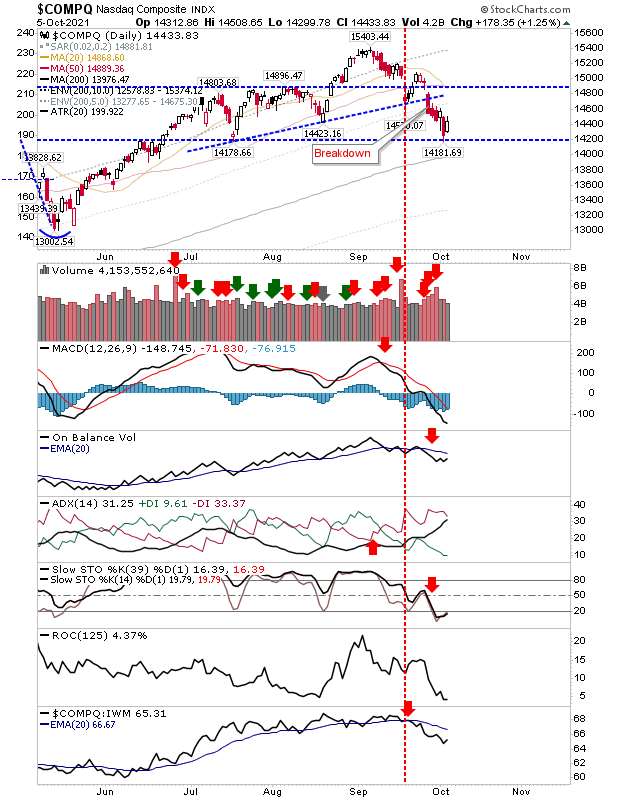

A Range Of Market Scenarios In Play

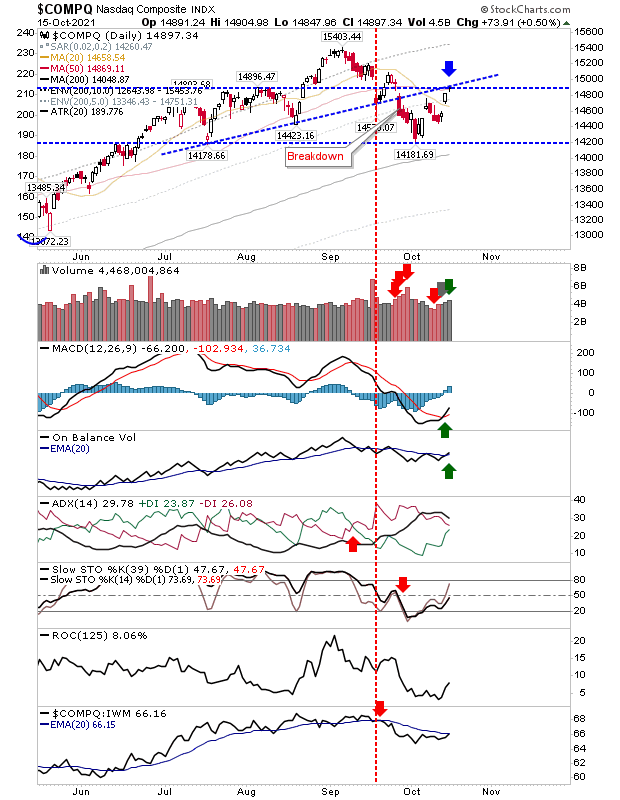

The week finished with markets in a number of difference scenarios. In the case of the Nasdaq, the rally has returned to former 3-month support - now resistance. Volume climbed to reigster as confirmed distribution. It came on a back of a MACD trigger 'buy' and an On-Balance-Volume 'buy' trigger.