The week opens with sellers controlling early action

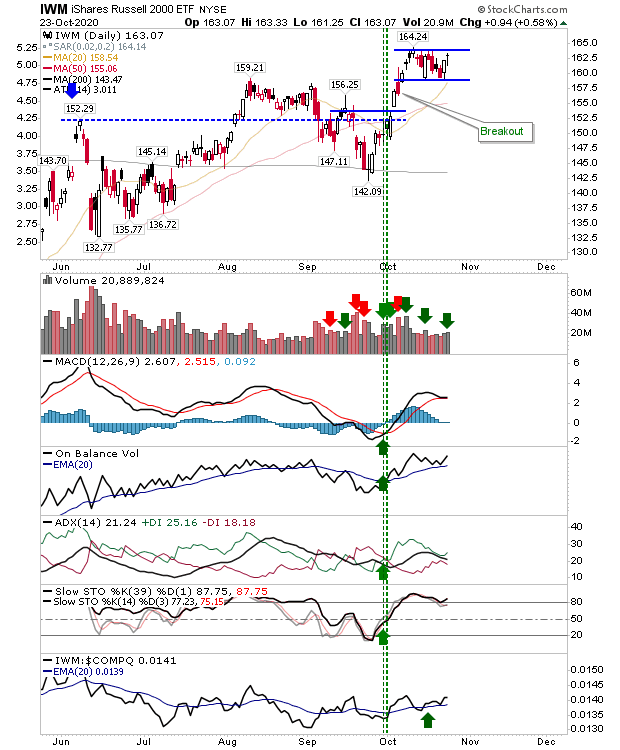

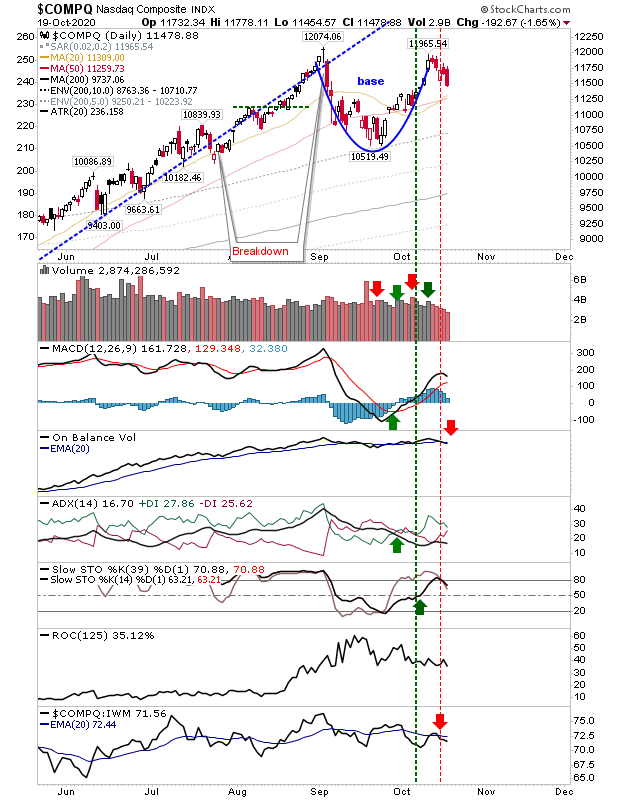

With the weekend to stew over things, sellers began the week pushing markets below 20-day and 50-day MAs. No index escaped the selling but whatever bullishness was there from Friday was quickly dissipated on Monday's action. The Nasdaq wasn't the worst hit, but it was enough to expand on the 'sell' trigger in the MACD and bearish crossover in the ADX. The index is underperforming the Russell 2000, which also suffered a loss today.