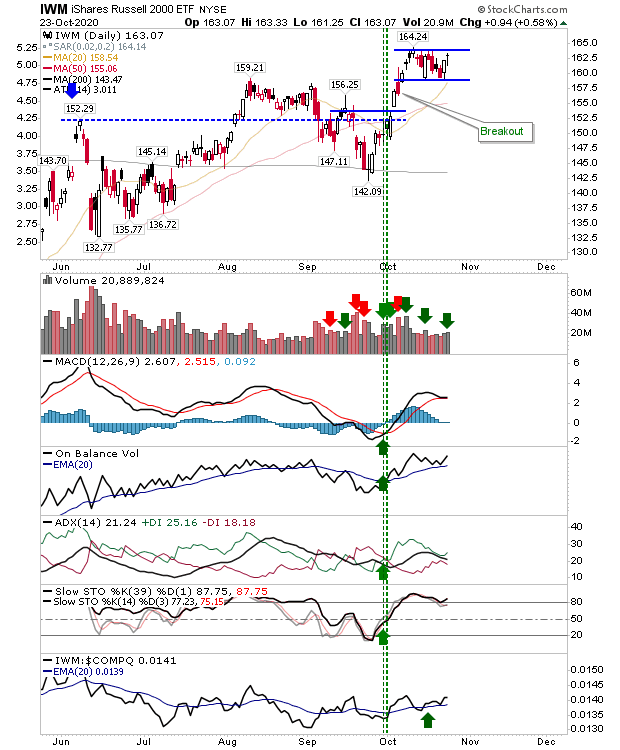

Russell 2000 Shapes Bullish Handle

Watching the (Covid19) World Series so will be keeping this post short. The main thing from Friday is the solid bullish handle taking shape in the Russell 2000. The breakout hasn't occurred yet, but the setup is looking good for the coming week. Technicals are all bullish. A stop would go on a loss of handle support and/or the trailing 20-day MA.