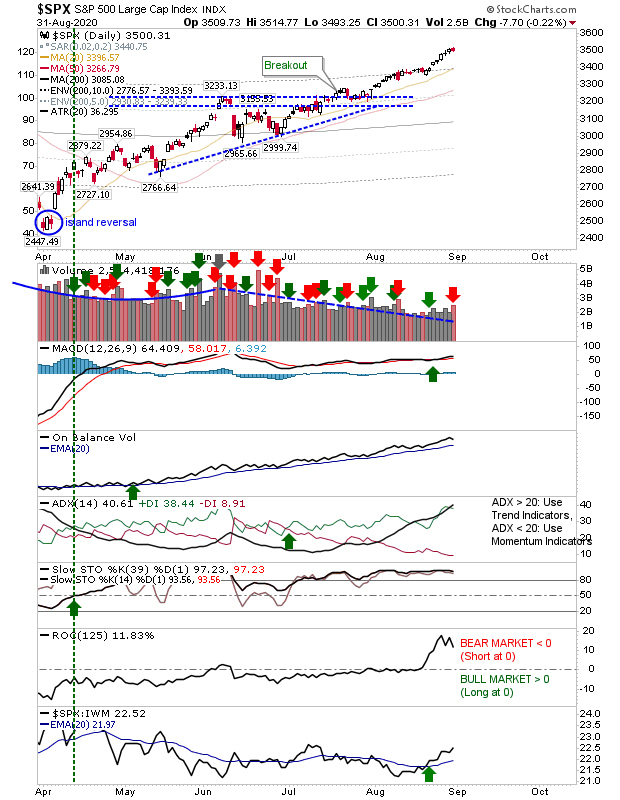

Sellers Appear With Volume in S&P But No Conviction

It was looking like an day for sellers to take control but while it was a down day with heavy volume disstribution, there wasn't any significant point loss to go with the selling. Losses in the S&P occurred on significant volume but without any major change in supporting technicals or price. With bulls looking for a crash on any sign of weakness, it`s going to be hard to see a crash occurring as markets continue to enjoy gains on the back of overbought conditions. Crashes do not occur when markets are overbought but when they are oversold, and markets are still a long way from this.