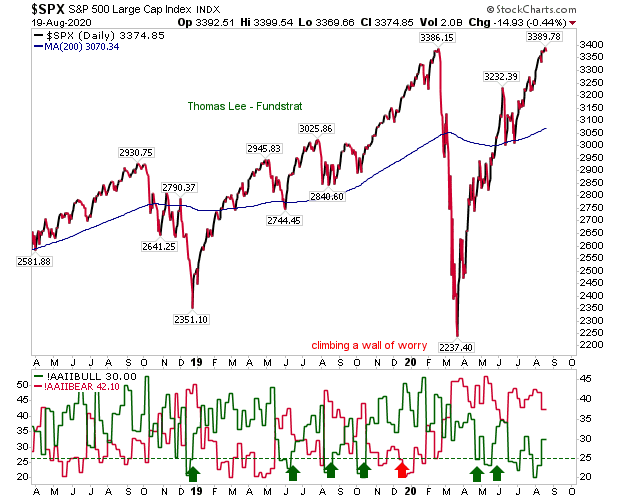

And the wait continues...

A day of small losses but no real damage to the rallies. With the S&P joining the Nasdaq in erasing Covid losses, everyone is waiting for sellers to sweep in and kill this rally but they might be for a surprise. The American Association of Individual Investors sentiment is firmly in the bear column, which means bulls may be the one to benefit as it typically plays as a contrarian indicator.