Market Gains Don't Reverse Damage

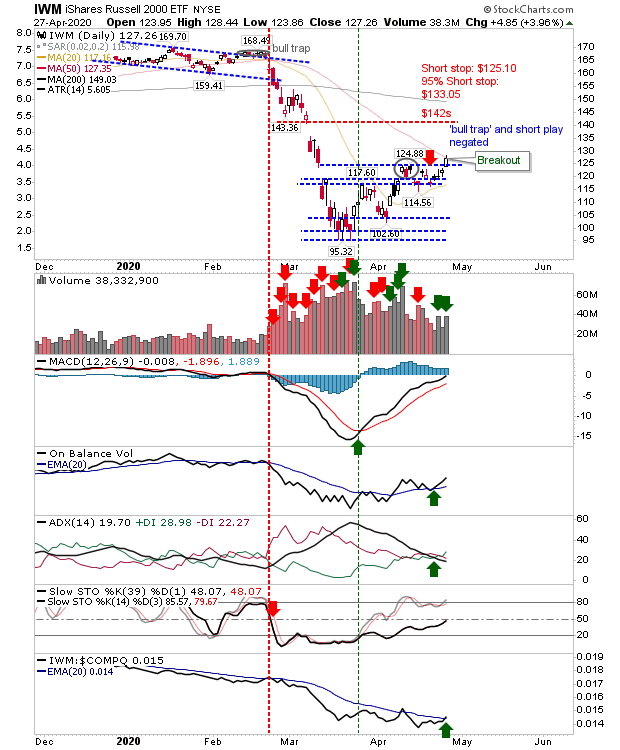

There were modest gains across the indices as markets digested last week's losses. The 'bull trap' and gap down remains a major concern for the S&P as today's buying only made a small indent into those losses. Volume was lighter as On-Balance-Volume looks ready to whipsaw back into a 'buy' signal.