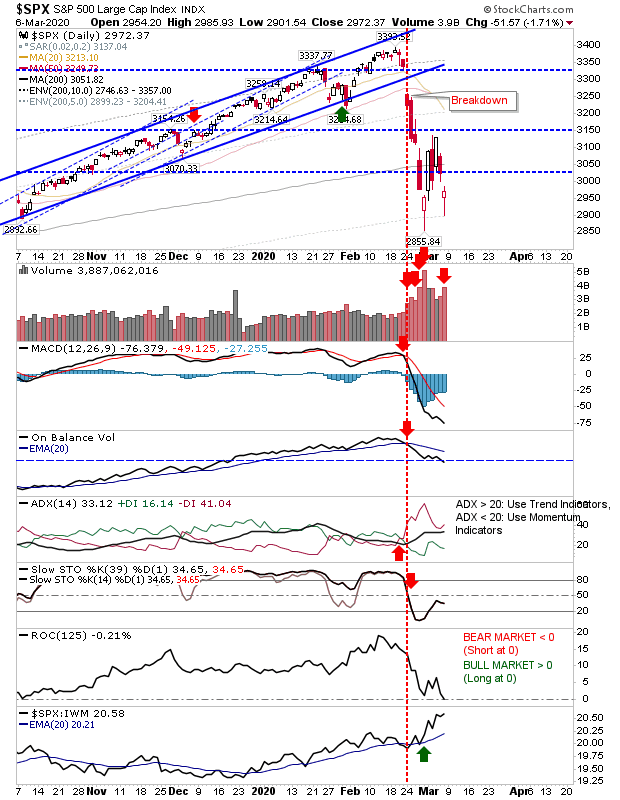

Now the test begins...

The bounce has stalled and now it's a question as to whether the swing low from February is one to be defended, or is simply a swing low in a measured move lower; a move which could see 2018 lows tested - although this would be a big stretch and a likely 'worse case' scenario. Again, just to reiterate, the 2009 low is a generational (55 year+) low and the rally which emerged is one which will see long (long) term gains. This is a sharp move down, but it won't last. Markets may move sideways for an extended period, which will 'feel bad' but is ideal for those looking to accumulate a position over time - such as in a pension or 401K. With that in mind, we have to deal with the present. The Coronavirus is here to stay (where are the anti-Vaxxers now...). We have a Chinese economy which is still trying to come to terms with the infection and the eventual economic fall out. We have a UK and US economy led by the most incompetent group of 'leaders' for whom