Reactionary bounce for indices

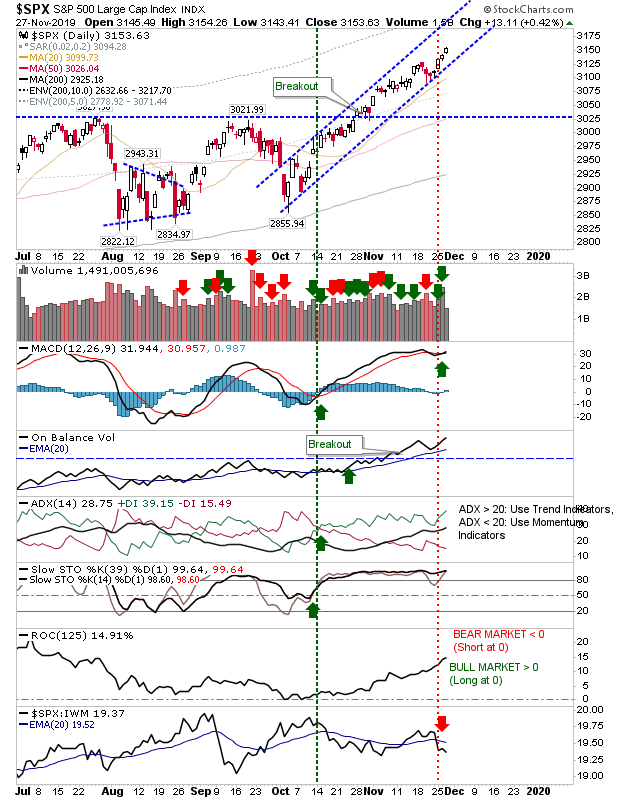

After yesterday's gap down there was a bit of a reactionary bounce to the selling. Indices have confirmed breaks from rising channels, so now it's a question of defining how long indices will move sideways for; there is still plenty of support to work with should indices fall further. The S&P has major support at 3,025 which is close to the 50-day MA. Volume fell, in line with consolidation action. A safe Hold for now.