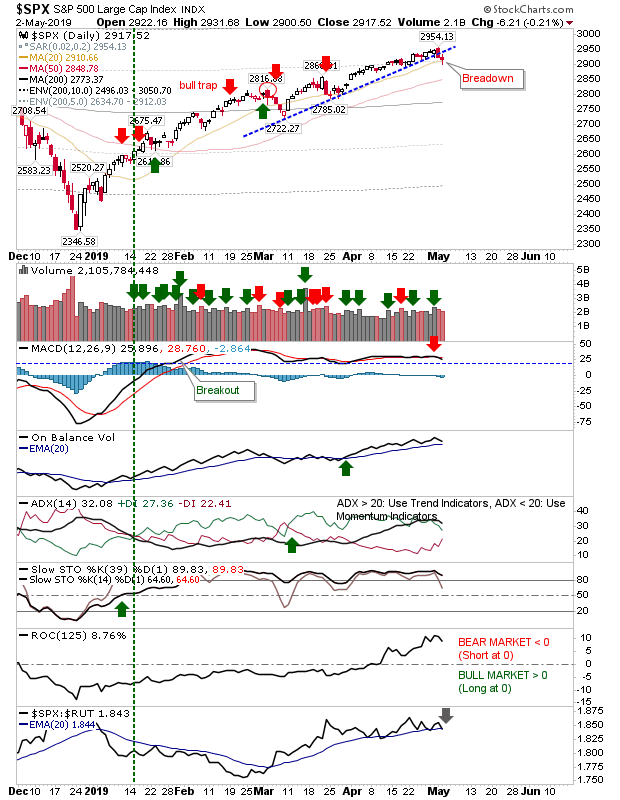

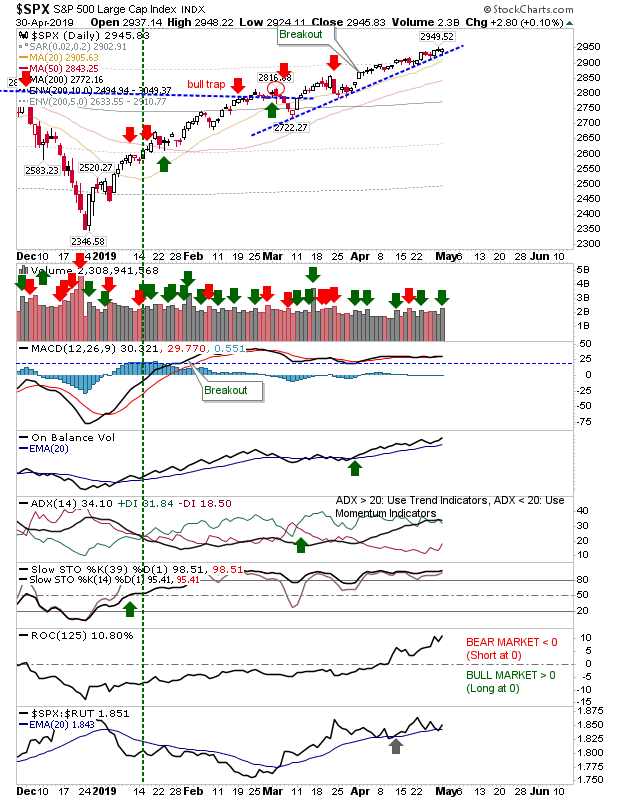

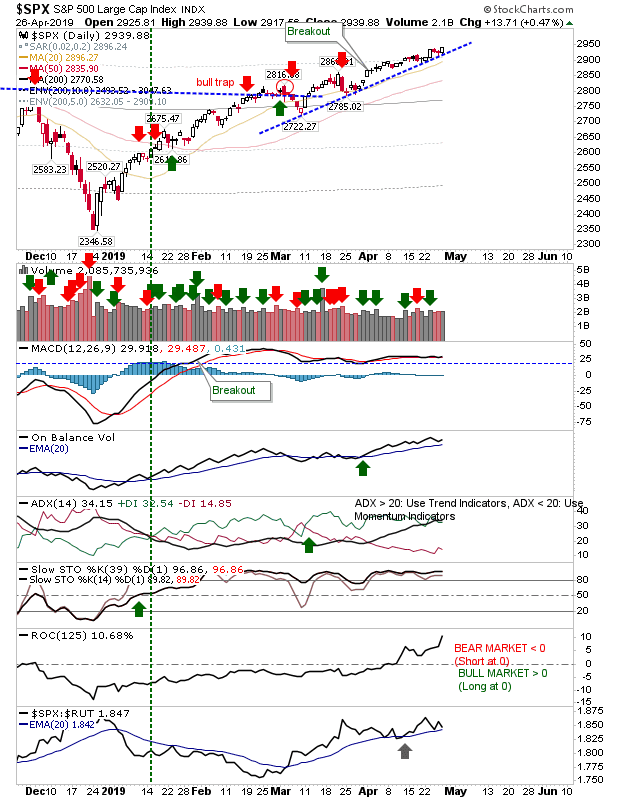

Bounce sees markets challenge moving averages

Since the Tariff sell off markets have managed to pull themselves back to the moving averages broken by that sell off. Buyers of the bounce off the 200-day MA in the Dow Jones Average are sitting pretty with another 100 points on offer before the 50-day MA is tested. Volume is light and technicals are mixed, but there has been a recovery 'buy' trigger in On-Balance-Volume.