Short Trades Limp Out

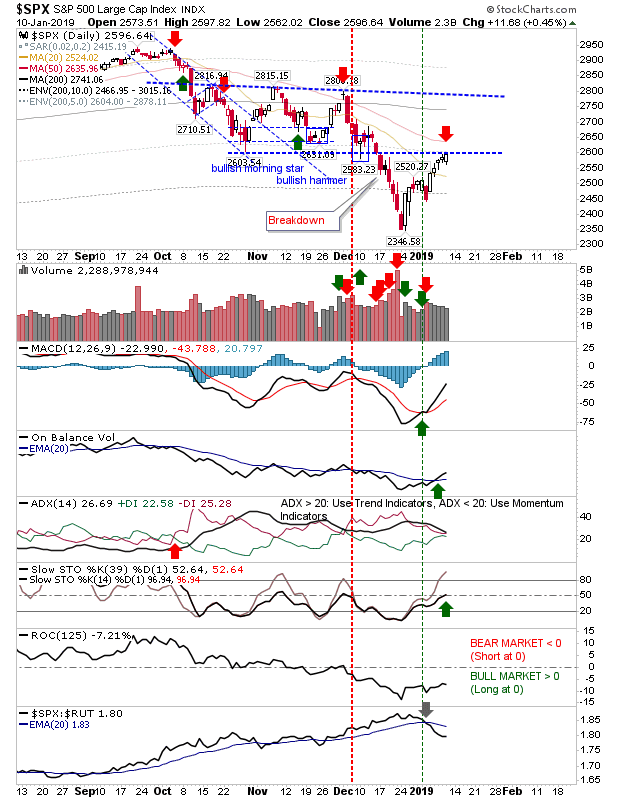

Yesterday's swing trade will have stopped out the aggressive short trades at the narrow doji, where the doji range was used as a stop. Shorts using the 50-day MA as a stop will still have a little room left to play with. Those looking for a new shorting opportunity may use today's doji as the entry trigger; shorting loss of doji low with stop on break of doji high (or a long trade on the reverse break). The aforementioned trade looks clearest on the S&P where it edged above resistance but not enough to break beyond the 50-day MA; I have marked a second (short) entry signal but if it closes above the 50-day MA then the last chance saloon for these trades will be done. It's a similar picture for the Dow Industrials Somewhat ironically, the Semiconductors might have the best shorting play; we have a close near the low of the day after peaking last week. The index is above the 50-day MA but it's not looking like it will stay there much longer. There is an