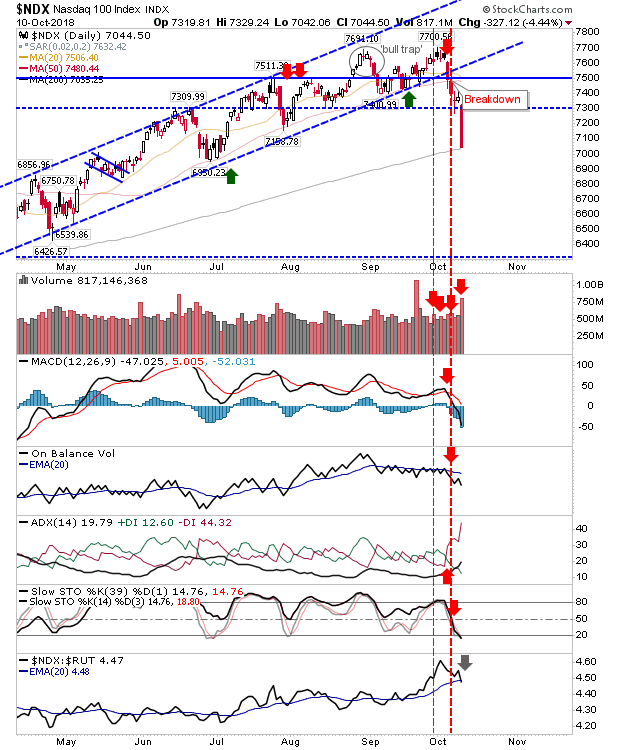

Friday's Bounces Ease Back a Little

There was no real surprise to see the gains from Friday come back a little as Thursday's lows play a siren song. The most likely outcome is a consolidation pennant as prices focus off last week's lows - this might take a week to play out but the surge in volatility may see some pushback to stabilize price action. The S&P finished just below 200-day MA as it inches back to 2,710 lows. I would be looking for more small losses or a neutral doji. The best of the action is the strong relative performance (against Small Caps) which runs contrary to price action itself.