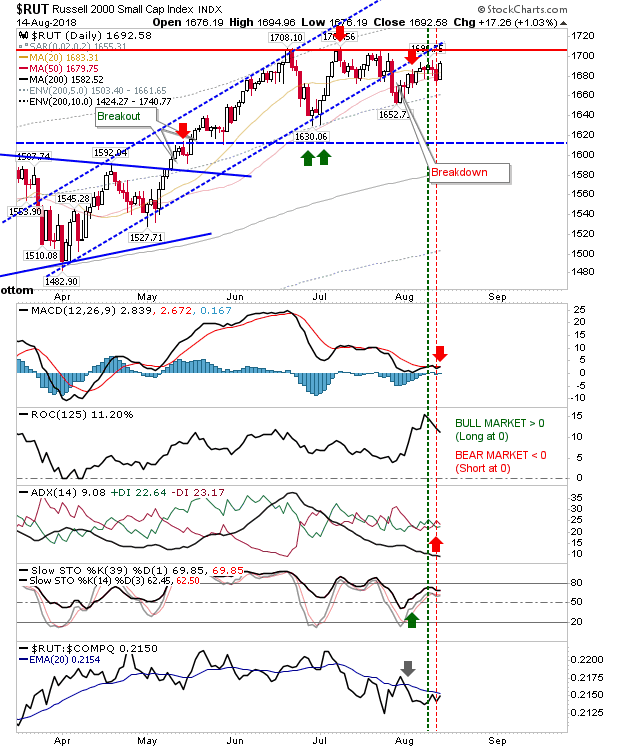

Small Caps Recover Strongly as Nasdaq Breakout Stabilizes

Buyers made a strong defense of the Russell 2000 as yesterday's losses were reversed - and then some. However, there is still some 2-3 days worth of buying required before it can be said to be challenging new highs. Weak shorts will have covered today but more staunch shorts will be feeling nervous; a move above 1,710 is a cover of any short.