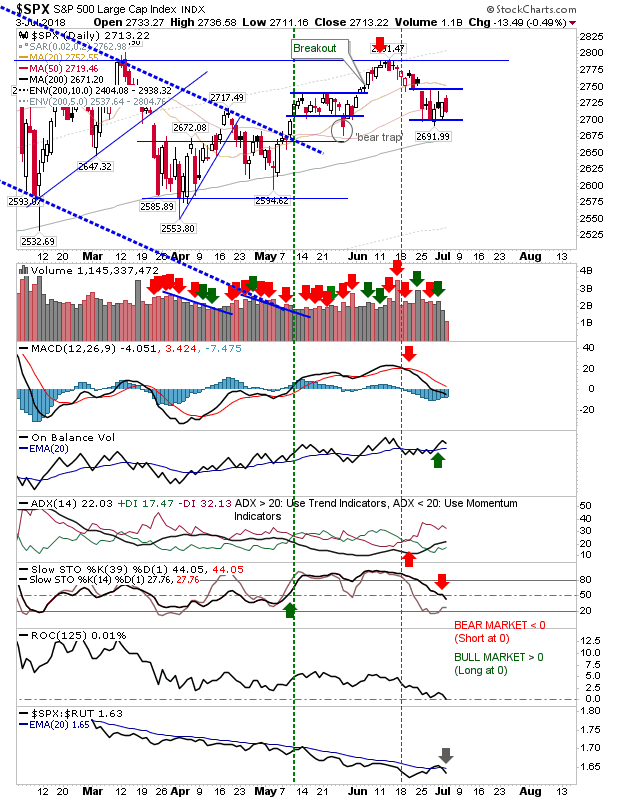

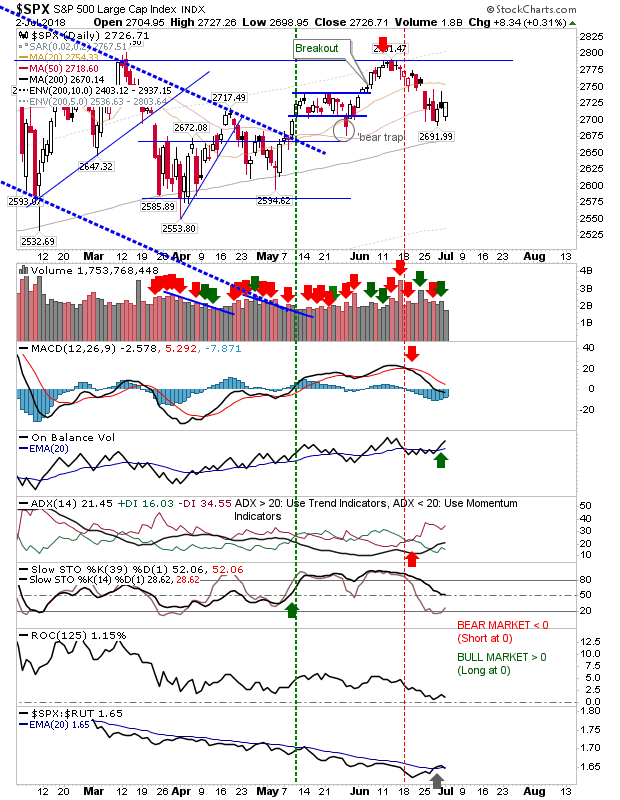

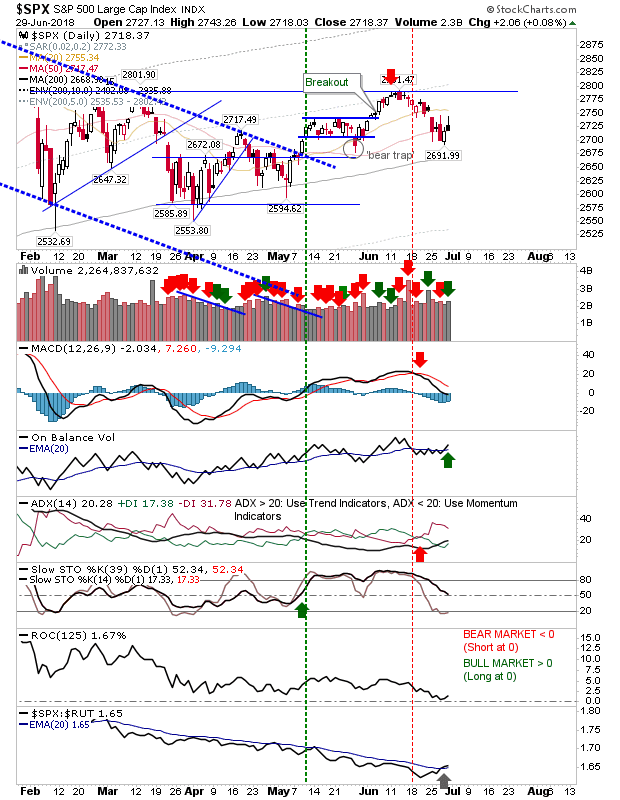

In yet another turnaround for markets, today started with a large gap down which had the makings of a sizable bearish sell-off - only for bulls to start buying from the open and to continue to do so throughout the day. Better still, today's surge undid much of the damage done Friday. For the S&P, the action over the last six days has much in common with the scrappy action around the 200-day MA in March/April. The only thing I don't like about this action is the frequency of the tests of the 200-day MA; the more frequent the tests the greater the chance for a break. A move above the 20-day MA should be enough to confirm a new swing low and deliver a challenge on resistance of the June swing high; riskreward measured on a loss of 2,690. There was even an uptick in relative strength against the Russell 2000.