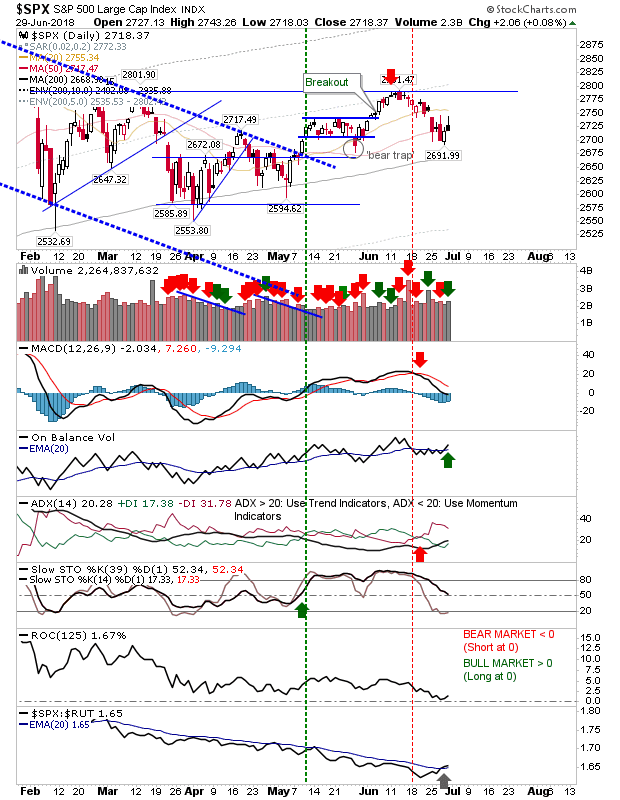

Supply Issues Emerge As Bounce Stalls

Friday's action didn't bring about the bounce I would have liked after Thursday's picture-perfect defenses of lead moving averages or support. The S&P closed with a bearish black candlestick on a spike high above the 50-day MA. Volume climbed in accumulation as On-Balance-Volume triggered a 'buy' signal. I would see this as a bearish close and would look for downside Monday; potentially playing for a test of the 200-day MA