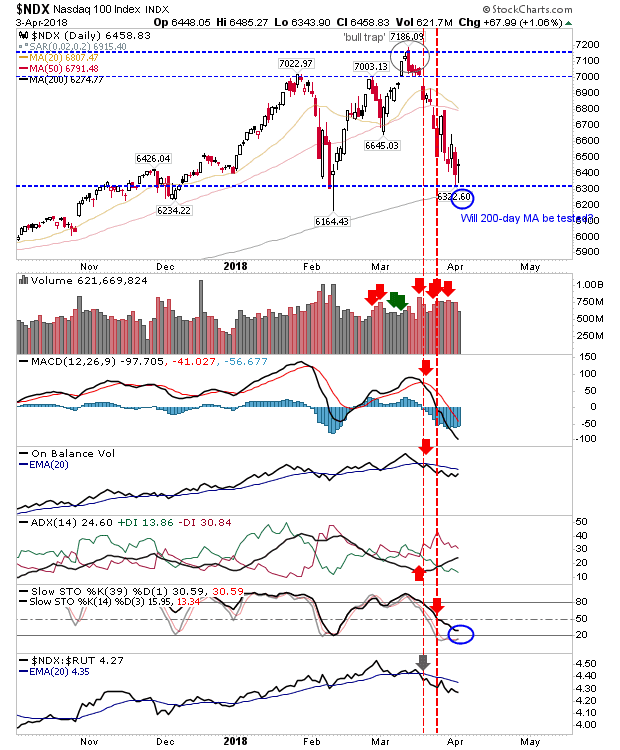

Bullish Harami Crosses Offer Swing Low Potential

Today's action didn't break the bounds of Friday's range but did create a scenario where solid swing lows develop; bullish harami crosses are one of the most effective swing low markers. The best opportunity can be found in the Nasdaq 100. A rally from here would suggest the makings of a trading range which I have marked in the chart below. The typical stop is a loss of 6,320 but I would use a decisive break of the 200-day MA as a stop.