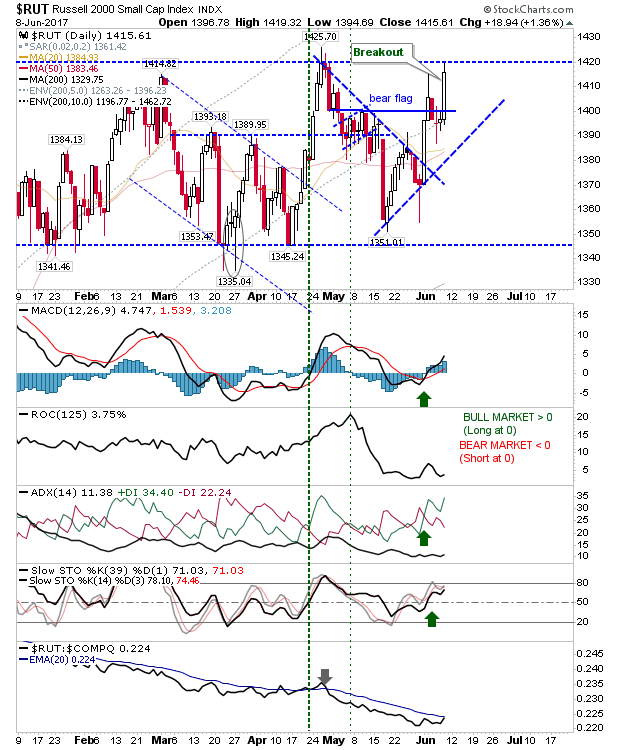

(Pre-) Breakout in Russell 2000

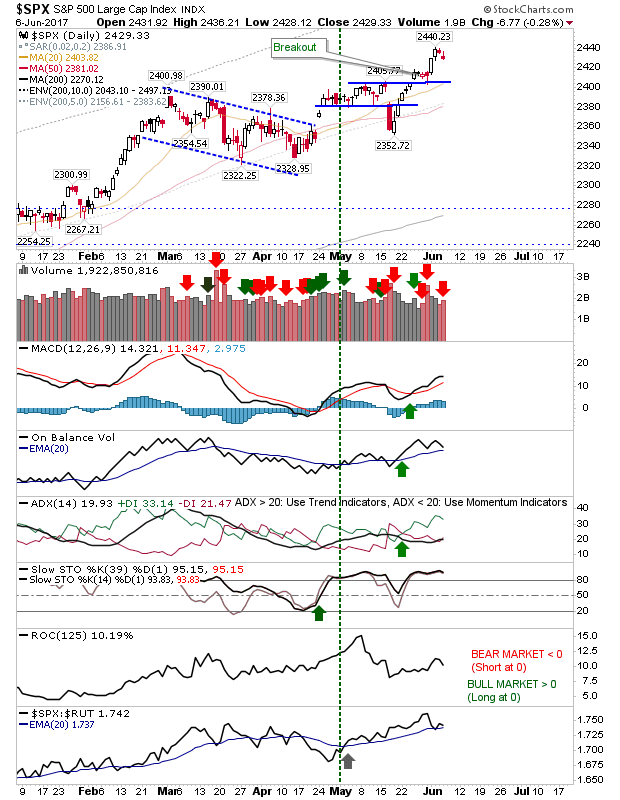

There wasn't much to attract interest but the Russell 2000 managed to stick its head above the parapet with a solid gain. The Russell 2000 was left just shy of challenging trading range resistance. Other indices are trading in a tight range which builds tension for a reactionary move; given what's happened in Small Caps, a breakout higher is perhaps favored. The Russell 2000 cleared inner resistance of the 'bear trap' and brought the index to trading range resistance. Tomorrow, watch for a consolidation at 1,420 before the Russell 2000 pushes higher.