Second Day of Profit Taking

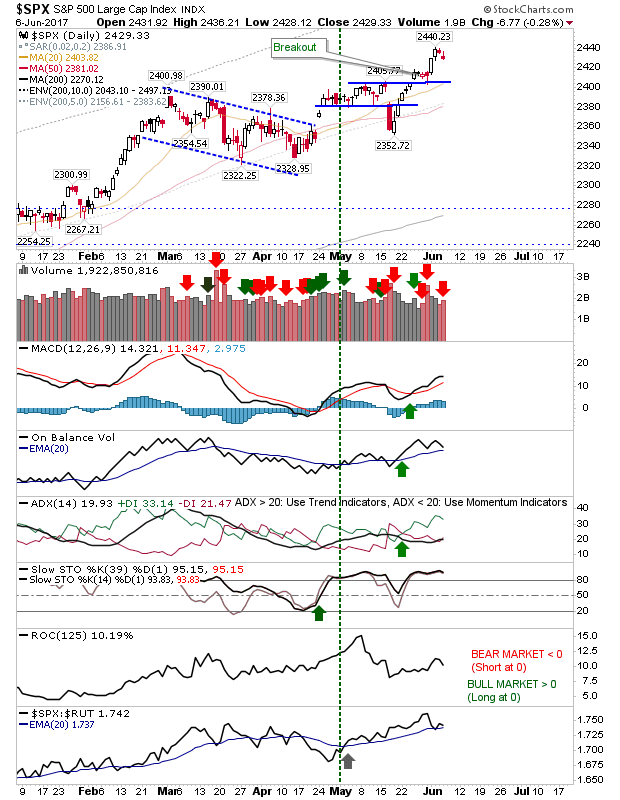

Higher Volume distribution took hold in indices but there was no significant point loss to go with the selling.

S&P gains posted late last week are holding while breakout buyers have yet to feel the pressure of this week's losses. The surge in S&P relative performance has weakened but hasn't yet pushed a 'sell' trigger.

The Nasdaq hasn't experienced the slow down in relative performance as the S&P which means trend traders are still in control. Other technicals are net bullish, but it didn't escape the distribution selling experienced by markets today. However, buyers are very much in control here.

The Russell 2000 struggled, but the larger (sideways) consolidation trend is the primary influence and until this is breached any action between such support and resistance should just be considered noise.

For tomorrow, bulls will not want to let losses accelerate as it will point to something more than profit taking and encourage shorts to attack rallies. Having said that, long term buyers don't have a lot to work with other than perhaps the Russell 2000.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.

S&P gains posted late last week are holding while breakout buyers have yet to feel the pressure of this week's losses. The surge in S&P relative performance has weakened but hasn't yet pushed a 'sell' trigger.

The Nasdaq hasn't experienced the slow down in relative performance as the S&P which means trend traders are still in control. Other technicals are net bullish, but it didn't escape the distribution selling experienced by markets today. However, buyers are very much in control here.

The Russell 2000 struggled, but the larger (sideways) consolidation trend is the primary influence and until this is breached any action between such support and resistance should just be considered noise.

For tomorrow, bulls will not want to let losses accelerate as it will point to something more than profit taking and encourage shorts to attack rallies. Having said that, long term buyers don't have a lot to work with other than perhaps the Russell 2000.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.