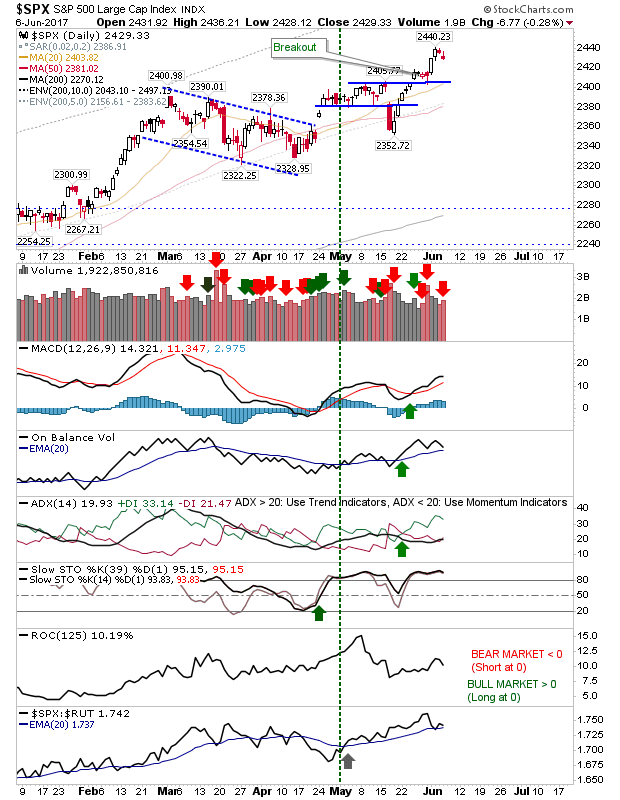

Low Key - Healthy Bullish Action

Today was the perfect day for bulls looking for buying opportunities. Markets exhibited small bullish 'hammers' as part of a 3-day pullback; collectively shaping up as bullish flags. As an added bonus, volume rose to register an accumulation day. The S&P pullback will be confirmed on a move above 2,435 with a stop on a loss of 2,425.