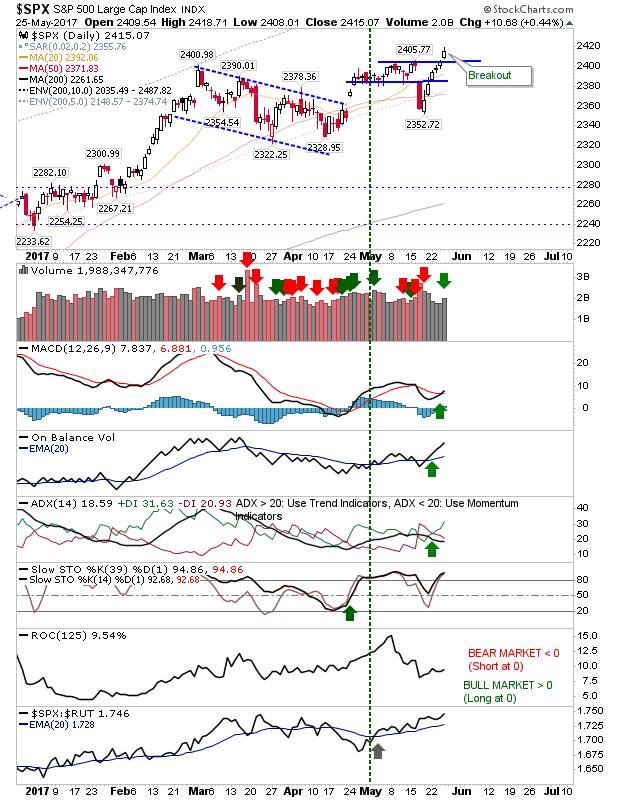

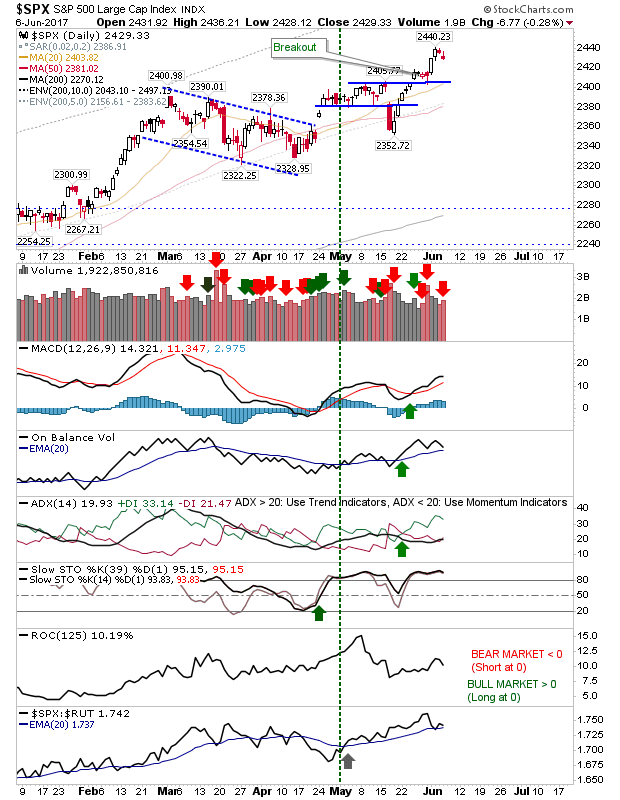

Second Day of Profit Taking

Higher Volume distribution took hold in indices but there was no significant point loss to go with the selling. S&P gains posted late last week are holding while breakout buyers have yet to feel the pressure of this week's losses. The surge in S&P relative performance has weakened but hasn't yet pushed a 'sell' trigger.