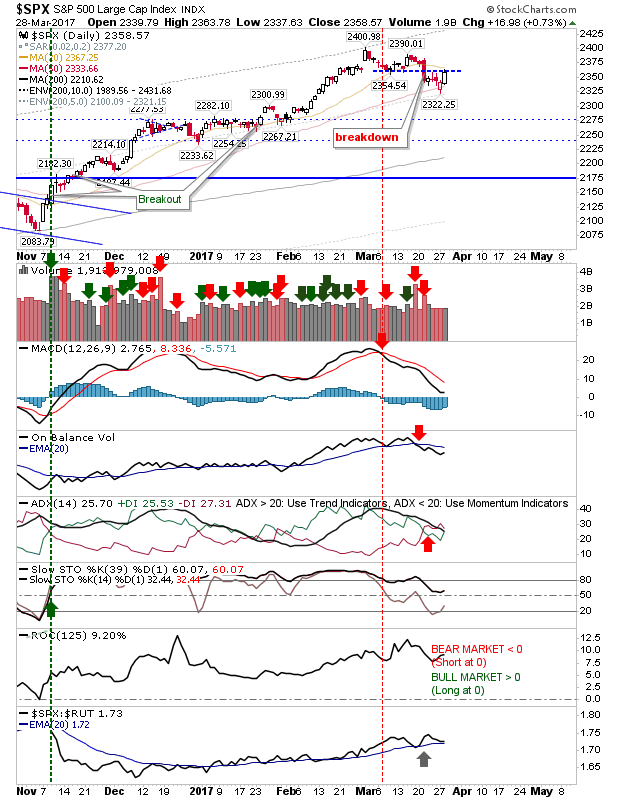

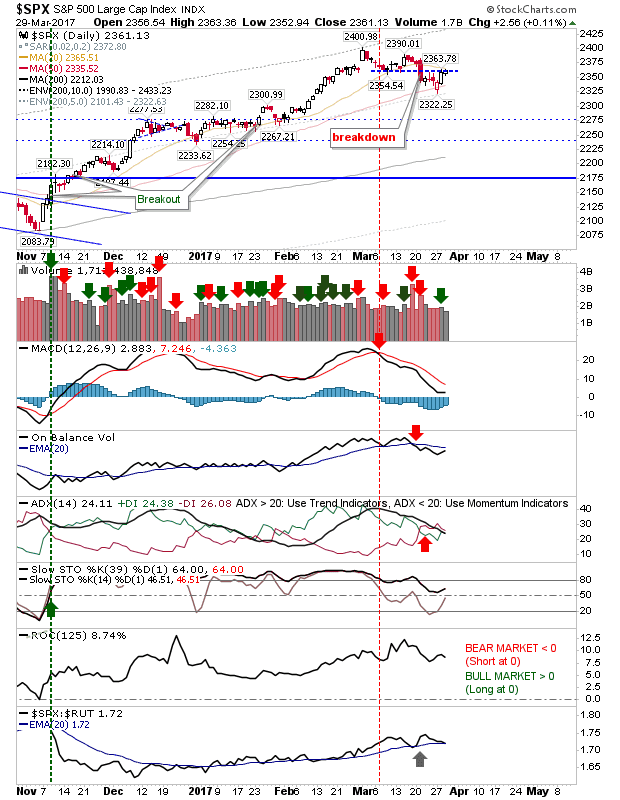

Rally Slows But Not Dead

The Swing Low continues to play out with small gains in lead markets. There is still resistance in play, but this supply is been consumed by the day. Trading volume was light too. The S&P is at resistance from the March swing low, but today's gain did little to get past this. Stochastics are bullish, but other technicals are negative and the last two days of didn't change this. While bears may think there is an angle to work, the most likely outcome is for a gain which returns a challenge of 2,400.