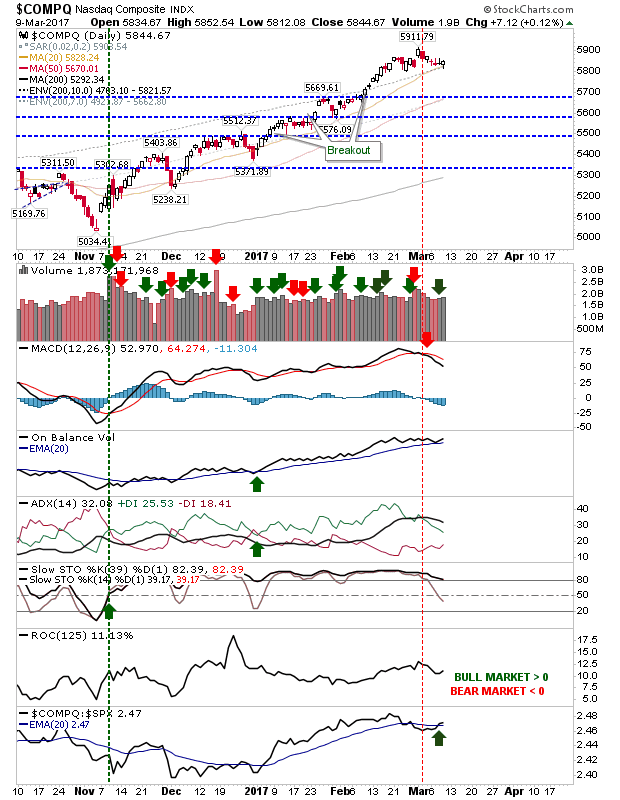

Small Gains On Accumulation

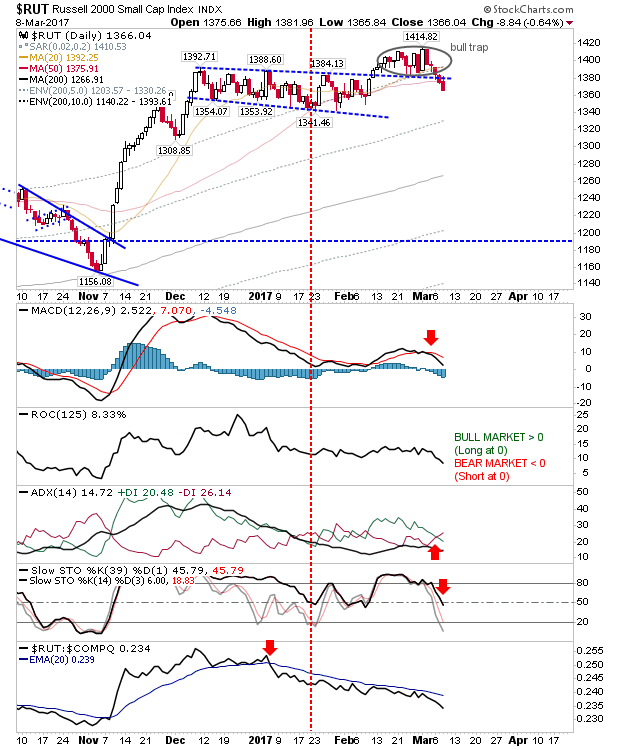

Markets finished the week with an accumulation day on Friday, with bulls coming in at 20-day MAs for the S&P and Nasdaq. The Russell 2000 also dug in, although buyers worked with no clear support level, but Friday's finish may offer an opportunity for a swing low to develop if there is some upside on Monday. The S&P worked a rally off its 20-day MA, but did so in the absence of accumulation. The 'sell' trigger in the MACD hasn't been reversed, but other technicals are still healthy.