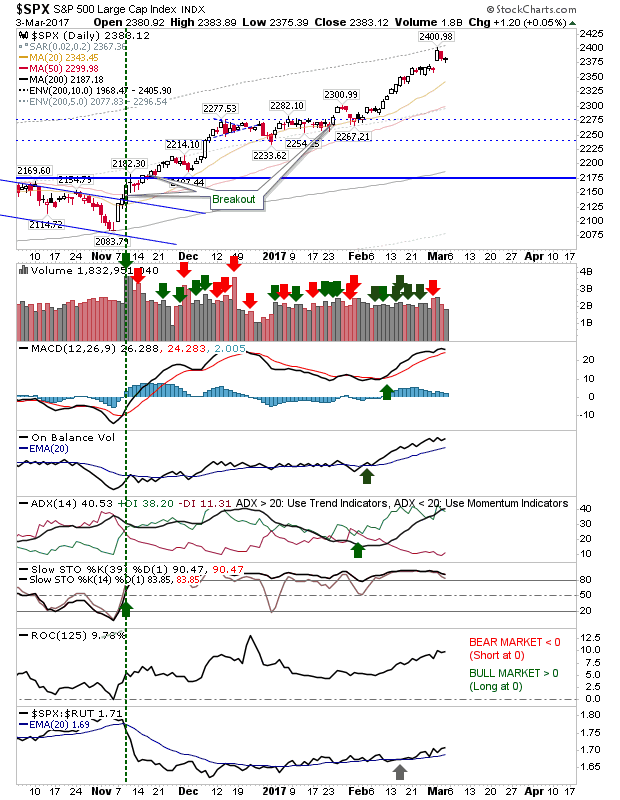

Status Quo

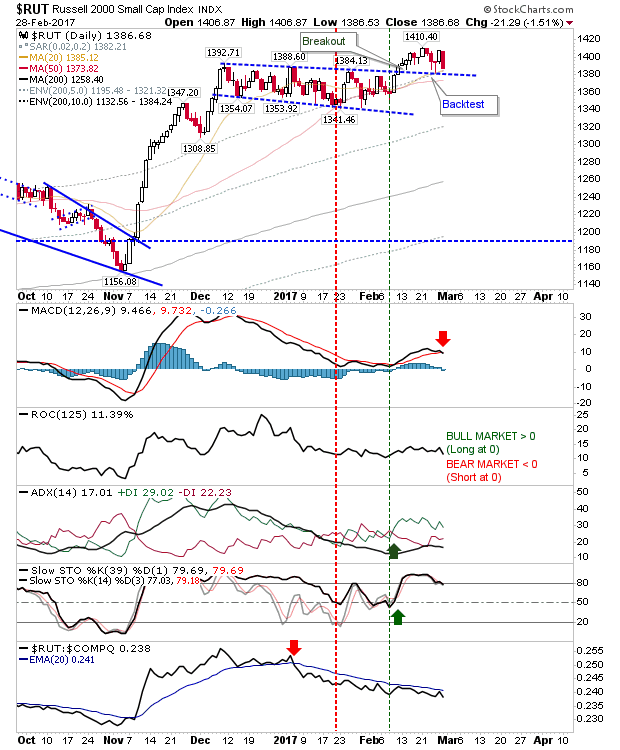

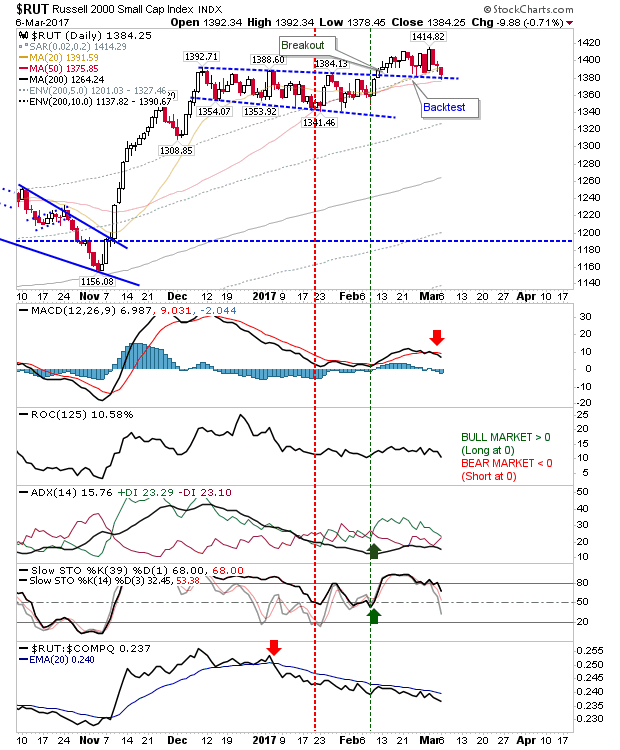

There wasn't a whole lot of change in markets with the Russell 2000 edging back to support. Small Caps remains the most vulnerable to an increase in profit taking with the 50-day MA playing as the last line of support. If there is a loss in such support watch for it to spread to other indices which are holding up better.