Markets Breakout

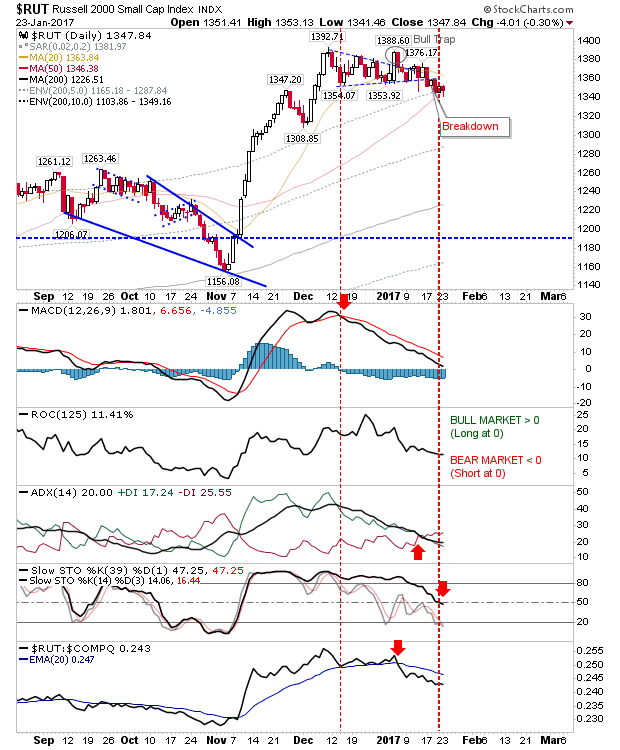

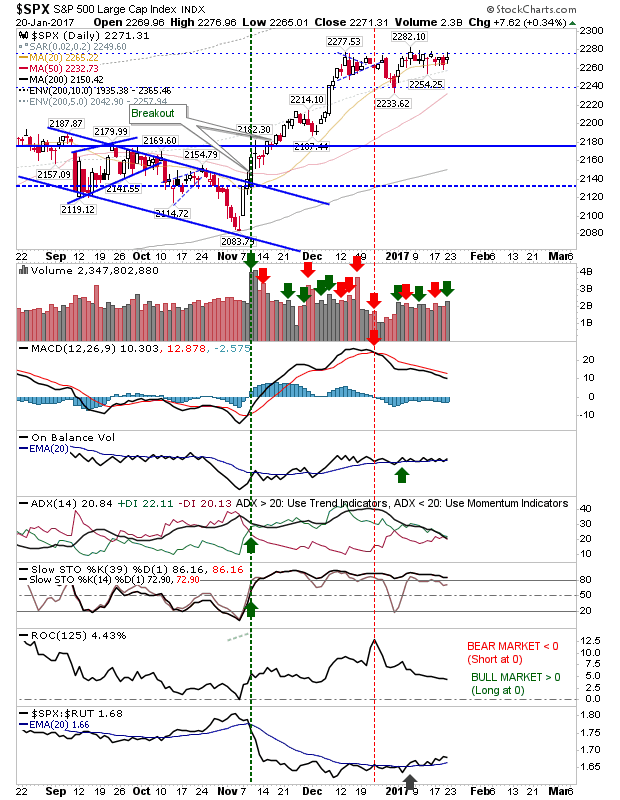

After yesterday saw the Russell 2000 finally switch to a net bearish turn in technicals, today saw markets move sharply higher. This generated breakouts for Tech and Large Cap indices. The S&P enjoyed higher volume accumulation as it cleared the consolidation dating back to the start of December. The gains, while welcome, weren't enough to generate a MACD trigger 'buy'