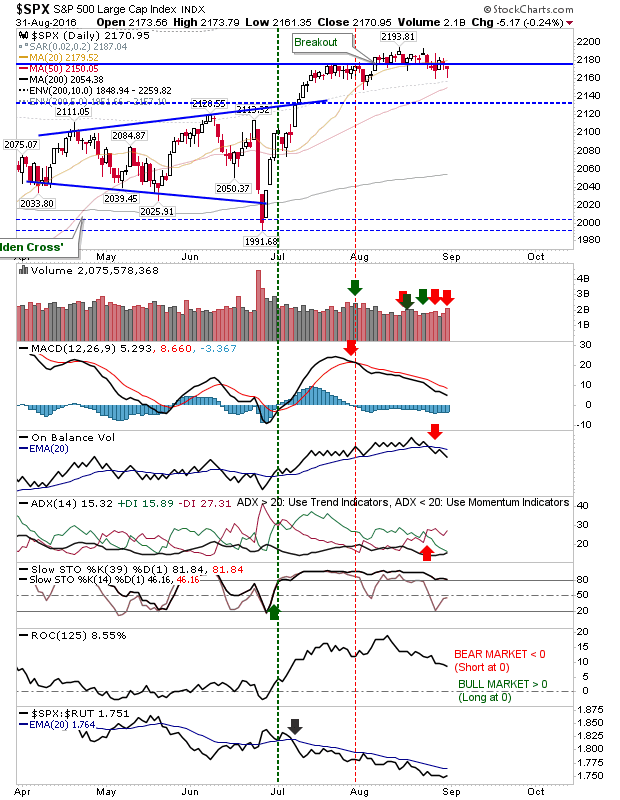

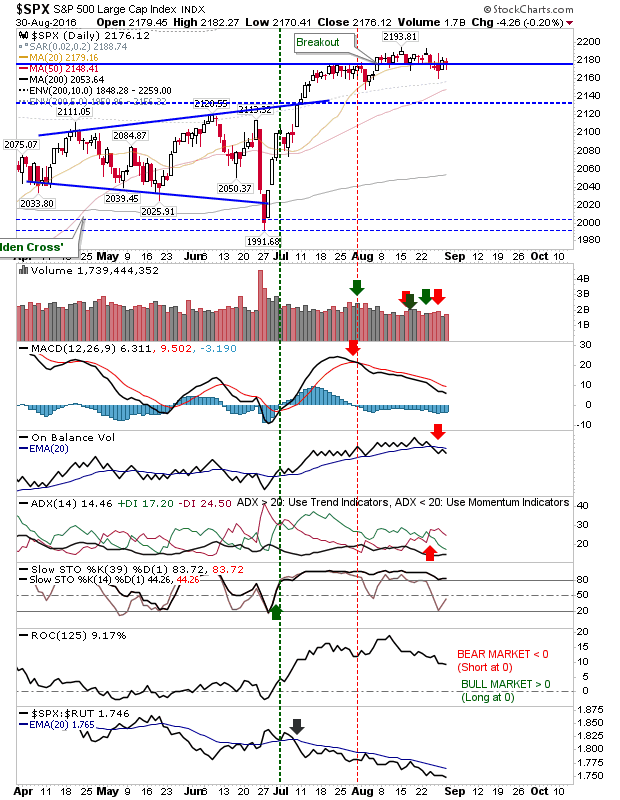

Post Labor Day Buying

Tuesday's action came as a bit of a relief for bulls worried the return of Traders from their holidays would kick start a wave of selling. For a while it had looked like sellers were about to get what they wanted with a picture perfect break from tight action (in the hourly chart), but it came back strong to close near highs. For example, the Dow showed this reversal nicely.