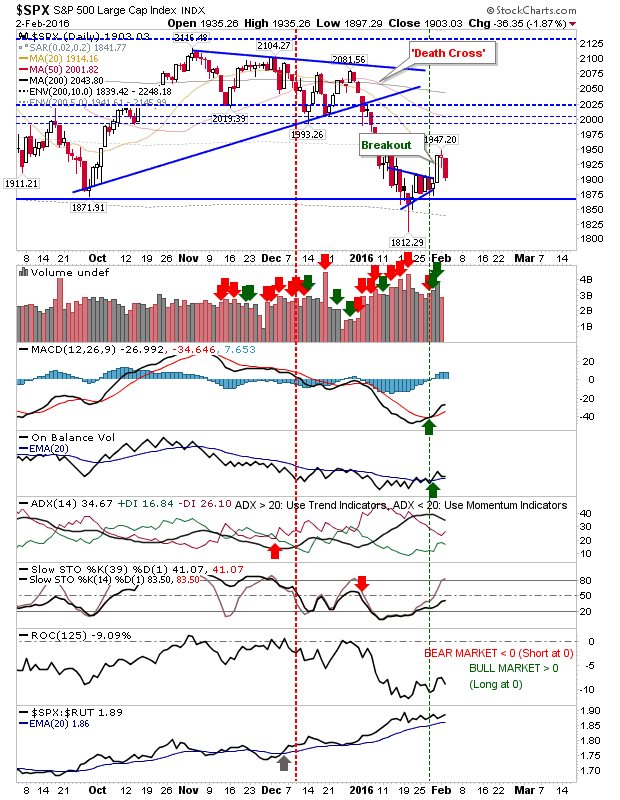

Sellers Start Day, Buyers Finish It

Tech averages had the weakest start, Powerful gap downs had set things off, but buyers were able to make a comeback into the close. However, morning gaps remain. Volume climbed to register as distribution, which for the Nasdaq was the second day of distribution in a row. The Nasdaq 100 is on the fiftth day of selling in a row. The August swing low wasn't fully tested. Bulls will be looking for a bullish 'morning star' where today's candlestick 'hammer' is followed by an opening gap, then a rally for the rest of the day. Should this emerge, then a move to test 4,300 is next. If there is a weak open, then any chance for a bullish 'hammer' based on today's action is significantly weakened. Losses in the S&P, while comparable to the Tech indices, didn't see a loss of January's lows. Today's spike low did fall inside the range of January's spike low. This will offer grounds for a positive response tomorrow; today's lows