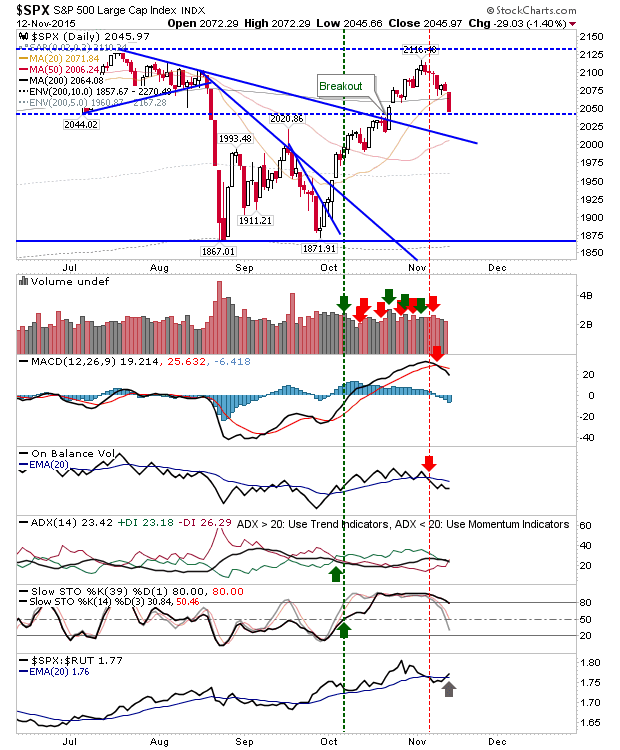

Sellers Stick Around For Another Day

Another day of selling took markets further away from their highs and into more well defined profit taking. Near term, there should be a rally to mount a retest of October highs, and how this rally behaves will determine if this is a pullback or just a relief rally. The index to guide this differential will be the Russell 2000. Friday saw a finish on former declining resistance trendline, turned support. Technicals are weakening, and another couple of days like Friday would be enough to shift this net bearish techincally. As it stands, the current sell off could still be viewed as a bullish pull back and Monday is nicely set up for a rally.