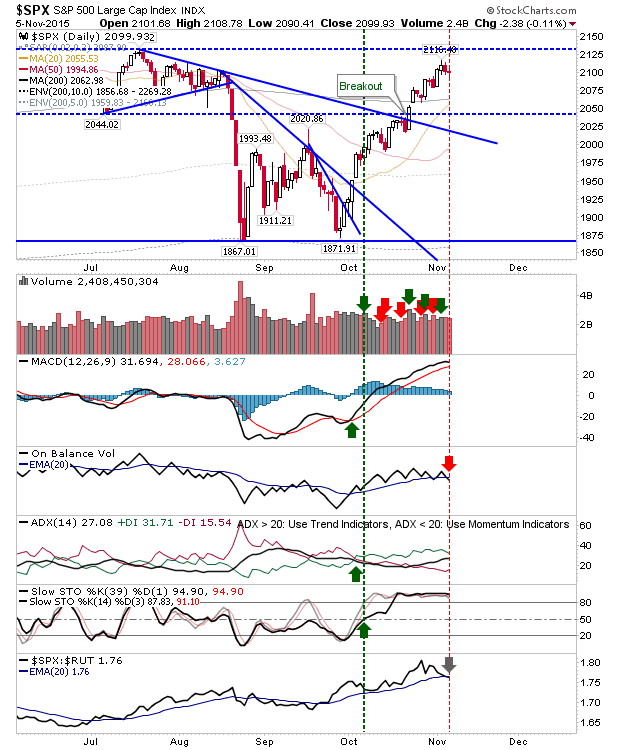

Sellers Apply The Squeeze

A surprising turn by bears (still 30 minutes until close) has undone all of Friday's bullish gains and quickly dropped indices back towards support levels. Unfortunately, my Nasdaq 100 short was knocked out at its stop pre-market. Had bulls not put the work they did to recover initial losses on jobs data I might still be in this. C'est la vie. The S&P fell back to converged support of the 20-day and 200-day MAs. There is some claw back from the lows, so this support could hold through tomorrow.