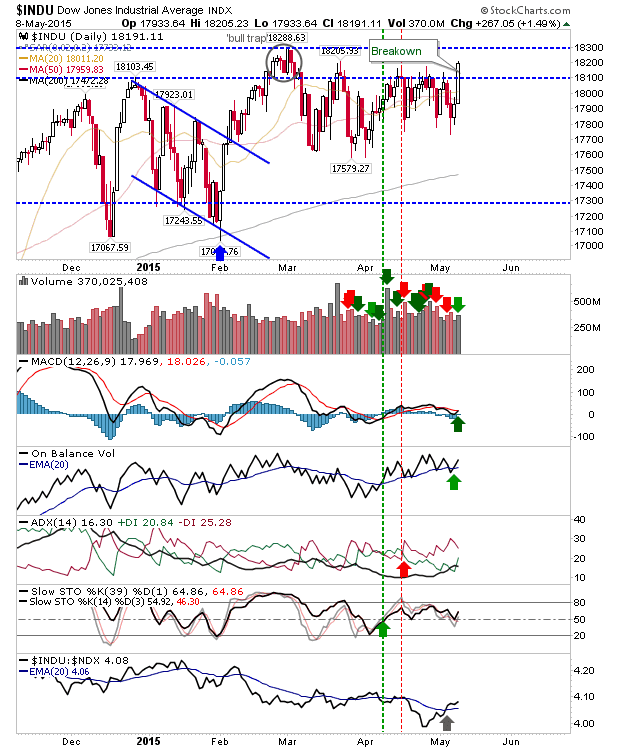

Range Bound Trading

Yesterday's recovery followed with further highs, but then buyers went AWOL and things settled back to the day's lows. Rinse and Repeat. The S&P has nestled itself against rising trendline support as today's action registered as confirmed distribution. Tomorrow, bears will be seeing if they can break the trendline, but I won't be holding my breath.