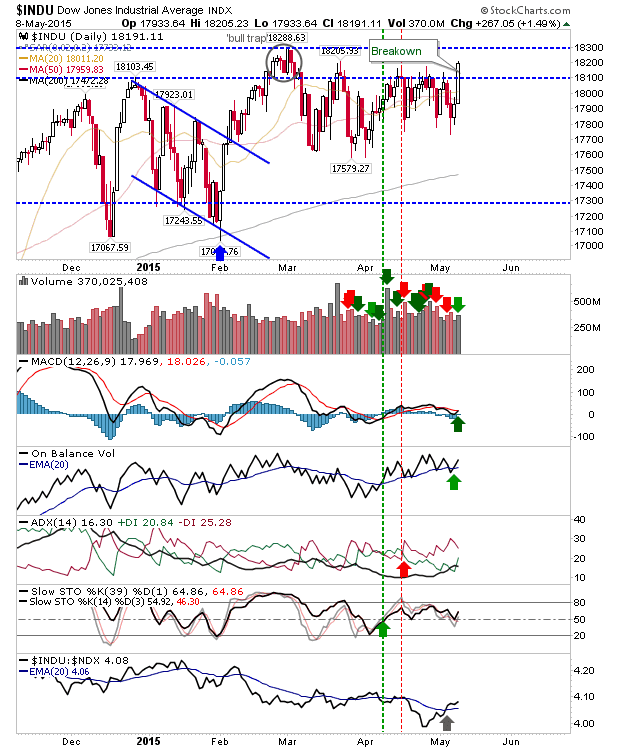

Dow Base Breakout

Star of Friday was the Dow Jones Industrial Average as it cleared congestion dating back to March, although there is still the 'bull trap' from February to clear. Volume climbed to register as accumulation, and it came with a MACD trigger 'buy' and On-Balance-Volume 'buy' trigger.

The S&P came close to an all-time breakout, but it finished just below a confirmed break of resistance. Technically, it's still working on MACD trigger 'buy', but it did have an On-Balance-Volume 'buy' to back Friday's action.

The Nasdaq created a potential 'bear trap', although a move into Friday's gap would not be unreasonable. Ideally, a spike low (i.e. a Monday close near day's high) would confirm bullish strength. Shorts may take a look at 5042/50 as part of a bearish head-and-shoulder pattern.

The Russell 2000 remains pegged by 1240 resistance, having failed to build on its opening gap. Shorts may find joy on Monday, particularly if pre-market action is weak. A move to the 200-day MA looks favoured at this time.

Bulls may need to worry about the negative divergence in breadth. Both Percentage of Nasdaq Stocks above 50-day and 200-day MA are in decline, and attempted breakouts in Nasdaq Summation Index and Bullish Percents have struggled to gain traction (and are well off highs).

For Monday, shorts should watch the Russell 2000 while bulls should watch the S&P - particularly if the Dow is able to maintain its breakout.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P came close to an all-time breakout, but it finished just below a confirmed break of resistance. Technically, it's still working on MACD trigger 'buy', but it did have an On-Balance-Volume 'buy' to back Friday's action.

The Russell 2000 remains pegged by 1240 resistance, having failed to build on its opening gap. Shorts may find joy on Monday, particularly if pre-market action is weak. A move to the 200-day MA looks favoured at this time.

Bulls may need to worry about the negative divergence in breadth. Both Percentage of Nasdaq Stocks above 50-day and 200-day MA are in decline, and attempted breakouts in Nasdaq Summation Index and Bullish Percents have struggled to gain traction (and are well off highs).

For Monday, shorts should watch the Russell 2000 while bulls should watch the S&P - particularly if the Dow is able to maintain its breakout.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!