Afternoon Surge Claws Back Morning Losses

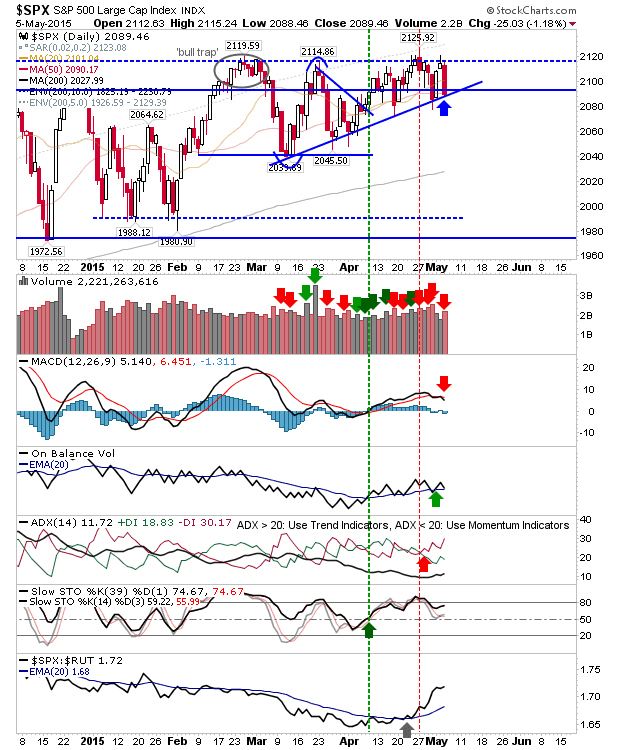

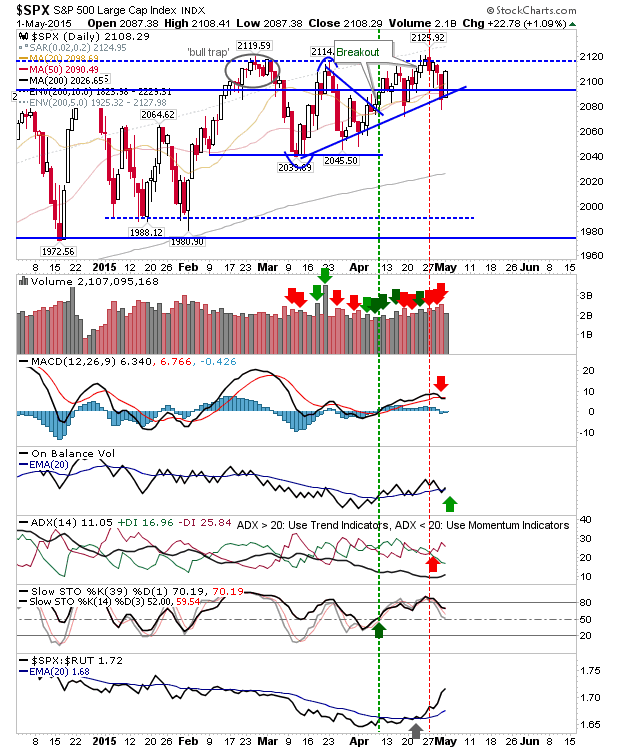

It was looking ugly for indices at the open, but by the close of business much of the day's declines had been reclaimed. For the S&P, the break of the rising trendline (and 50-day MA) was looking all but certain when sellers hit the index hard in pre-market trading, but Tuesday's finish does give bulls something to work with for Wednesday. Whether they can do anything about it is another matter. On the bright side, selling volume was down on Monday's buying; this kept the 'buy' trigger in On-Balance-Volume intact.