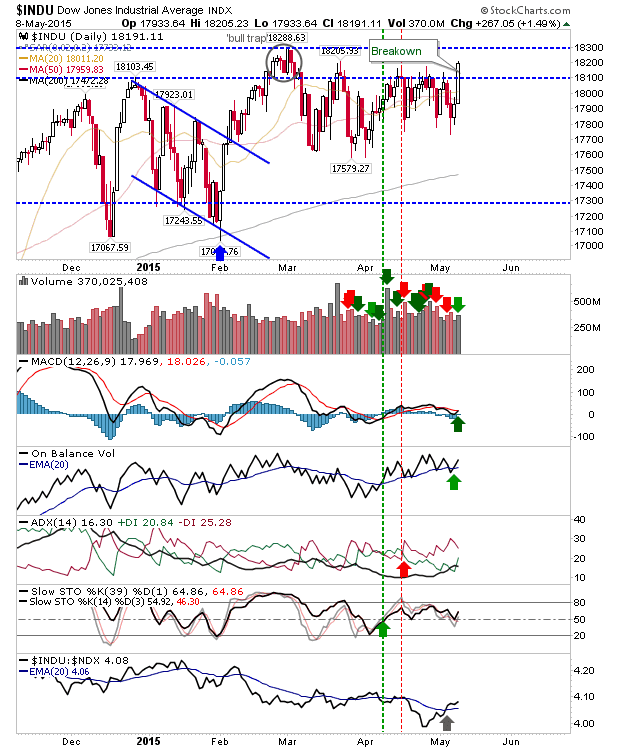

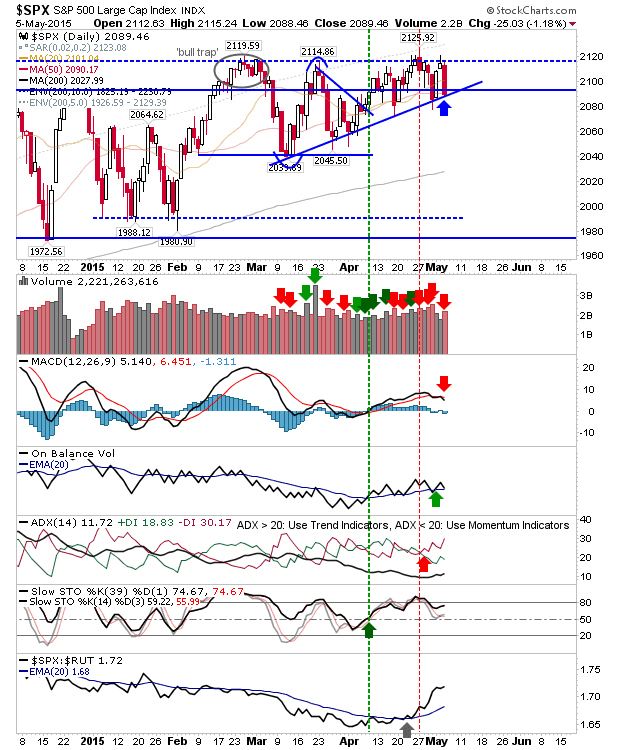

Lack of Follow Through for Markets

After Friday's gains in the Dow there was an opportunity for other indices to follow suit, but buyers suffered a bout of shyness. Tech and Small Caps finished the day near their lows after handing back early gains. For the Russell 2000, the day finished with an inverse hammer just below its 50-day MA (which is about to 'death cross' with its 20-day MA). The inverse hammer followed Thursday's indecisive doji, leaving the gap vulnerable to a fill tomorrow. A new downward channel may be emerging here and needs to be monitored.