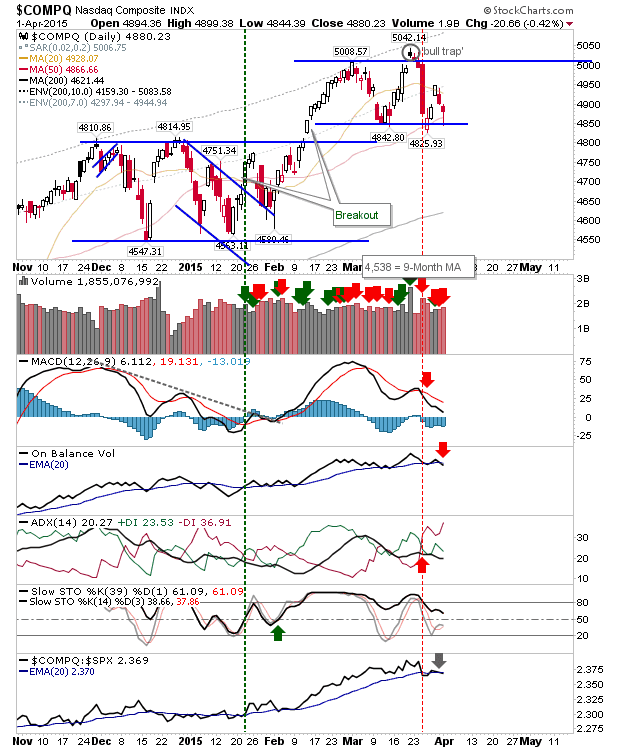

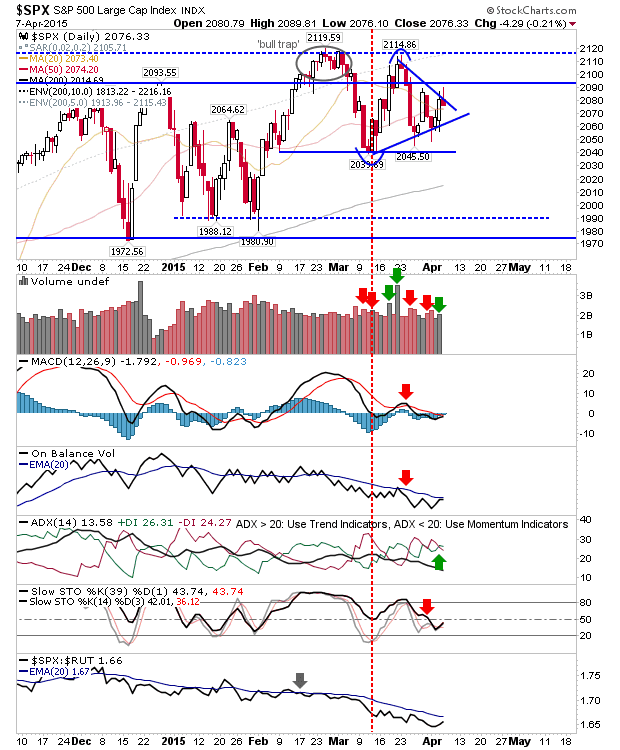

Late Selling Helps Build Market Consolidation

Markets are coiling towards a decision point (within a larger range defined by March high/lows), although markets sold off in late trading to give bears an opportunity to squeeze bulls tomorrow. If bears win, then a retest of March swing lows is favored, and failing that, a move to December lows. The S&P is oscillating around the 50-day MA. Today's high at 2,089 marks a short risk level for a push to the March low of 2,039.