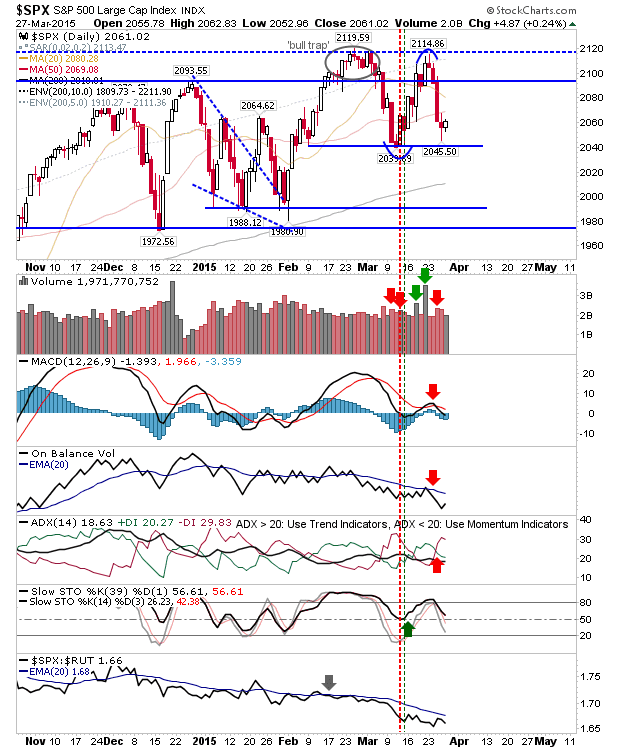

Small Caps pressuring 'Bull Trap'

The Dow had the best of the action, with higher volume buying to close the day out. The index closed above the 20-day and 50-day MAs. The next challenge is to push above 18,100; which is the 'bull trap' and the recent spike push to 18,205.